The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology - William Mougayar, Vitalik Buterin (2016)

Chapter 3. OBSTACLES, CHALLENGES, & MENTAL BLOCKS

“When the wind of change blows, some people build walls, others build windmills.”

-CHINESE PROVERB

ONCE, a youth went to see a wise man, and said to him:

“I have come seeking advice, for I am tormented by feelings of worthlessness and no longer wish to live. Everyone tells me that I am a failure and a fool. I beg you, Master, help me!”

The wise man glanced at the youth, and answered hurriedly: “Forgive me, but I am very busy right now and cannot help you. There is one urgent matter in particular which I need to attend to...”—and here he stopped, for a moment, thinking, then added: “But if you agree to help me, I will happily return the favor.”

“Of...of course, Master!” muttered the youth, noting bitterly that yet again his concerns had been dismissed as unimportant. “Good,” said the wise man, and took off a small ring with a beautiful gem from his finger.

“Take my horse and go to the market square! I urgently need to sell this ring in order to pay off a debt. Try to get a decent price for it, and do not settle for anything less than one gold coin! Go right now, and come back as quick as you can!”

The youth took the ring and galloped off. When he arrived at the market square, he showed it to the various traders, who at first examined it with close interest. But no sooner had they heard that it would sell only in exchange for gold than they completely lost interest. Some of the traders laughed openly at the boy; others simply turned away. Only one aged merchant was decent enough to explain to him that a gold coin was too high a price to pay for such a ring, and that he was more likely to be offered only copper, or at best, possibly silver.

When he heard these words, the youth became very upset, for he remembered the old man’s instruction not to accept anything less than gold. Having already gone through the whole market looking for a buyer among hundreds of people, he saddled the horse and set off. Feeling thoroughly depressed by his failure, he returned to see the wise man.

“Master, I was unable to carry out your request,” he said. “At best I would have been able to get a couple of silver coins, but you told me not to agree to anything less than gold! But they told me that this ring is not worth that much.”

“That’s a very important point, my boy!” the wise man responded. “Before trying to sell a ring, it would not be a bad idea to establish how valuable it really is! And who can do that better than a jeweler? Ride over to him and find out what his price is. Only do not sell it to him, regardless of what he offers you! Instead, come back to me straightaway.”

The young man once more leapt up on to the horse and set off to see the jeweler. The latter examined the ring through a magnifying glass for a long time, then weighed it on a set of tiny scales. Finally, he turned to the youth and said:

“Tell your master that right now I cannot give him more than 58 gold coins for it. But if he gives me some time, I will buy the ring for 70.”

“70 gold coins?!” exclaimed the youth. He laughed, thanked the jeweler and rushed back at full speed to the wise man. When the latter heard the story from the now animated youth, he told him: “Remember, my boy, that you are like this ring. Precious, and unique! And only a real expert can appreciate your true value. So why are you wasting your time wandering through the market and heeding the opinion of any old fool?”

This parable reminds of the fits and trials of Bitcoin, cryptocurrencies and blockchain technologies. Along their journey to gain legitimacy and be recognized, they have confronted plenty of skepticism and lower than deserved valuations, mostly during encounters with the part of the audience that could not fully appreciate their real worth.

The blockchain will meet resistance, be misunderstood and rejected, until it is widely accepted. This is a somber chapter in this book. If you read it on its own, you might decide that the blockchain will never succeed. Hopefully, you will not sell it short at the “market of fools,” like the above tale suggested.

Yes, there are plenty of challenges and unknowns, but we had similar blind spots and uncertainties during the early years of the Internet, from 1994 to 1998. Fast forward 15 to 20 years later, perceptions changed about the Internet. It became commonly accepted that almost nothing would be impossible with it. Pick anything. There is probably a Web-related solution or option for it, yet this level of market penetration was unthinkable during the early years.

Blockchains today are equally full of excitement and skepticism. The Internet turned out to be a wonderful tool, because the excited groups won over the skeptics. But that didn’t occur by happenstance, sheer enthusiasm, or just the passage of time. It happened because, early on, market participants were able to identify the challenges to the Internet’s commercialization, and one by one, they were tackled, such that the barriers of entry kept getting smaller and lower, and the opportunities became larger and more reachable.

I saw this up close with the Internet, around 1994, having participated in the advocacy of its early commercialization, through my affiliation with CommerceNet, whose sole purpose was to help remove the barriers to adoption, evangelize its vision, and expose its benefits, by working on technological, educational, legal and regulatory initiatives that lubricated the Internet’s early development days. The blockchain’s evolution will repeat the Internet’s history, undoubtedly.

ATTACKING THE BLOCKCHAIN WITH A FRAMEWORK APPROACH

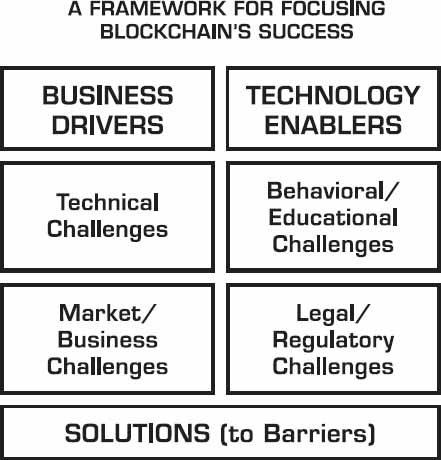

Let us look at the blockchain holistically through the lense of a Catalyst-Barrier-Solution framework perspective. This framework consists of accurately depicting the catalysts: business drivers and technology enablers. Then, we can table the barriers that include technical, business/market, legal/regulatory, and behavioral/educational challenges. Finally, we have a responsibility to tackle the solutions to each one of these barriers, one by one.

There should not be any illusion about the reality needed here. If we ignore the issues behind these barriers, many of them will not get solved on their own, nor will they go away, but we need to keep moving progress in the right direction.

The message behind this framework is to help us focus on what’s important. Progress happens when business drivers are strong, when technology enablers are ready, and when solutions to challenges are found.

Here’s a table of these challenges, categorized into four sections.

|

TECHNICAL |

MARKET/BUSINESS |

|

|

|

BEHAVIORAL/EDUCATIONAL |

LEGAL/REGULATORY |

|

|

TECHNICAL CHALLENGES

Software engineers and scientists love to face technical challenges. It motivates them further to try and solve them, no matter how hard they are.

Underdeveloped Ecosystem Infrastructure

As a starting point, each blockchain needs its own technology infrastructure, as well as a vibrant ecosystem around it, with a number of participants to support it. On the technology side, the protocol itself is a minimum requirement, and while it needs to be augmented by software tools and services to make it useful, it is the ecosystem of players around the technology that directly influences a blockchain’s market progression. Without adoption, there is little impact.

Just as the whole of the Web works as an ecosystem, the blockchain ecosystem will follow the same emancipation path, resulting in a mesh of interconnected blockchains, even if in the meantime, it will feel like some pieces of the orchestra are missing.

A vibrant ecosystem includes a variety of players in each one of the following segments:

· Complete technology stack, including infrastructure, middleware, and software applications

· Startups that innovate by creating new products and forging new markets

· Solutions and services providers that deliver end-to-end implementation for enterprises

· Funders and venture capital that take risks alongside the entrepreneurs and scientists

· Advocates, influencers, analysts, volunteers, supporters, local communities

· Developers and technologists who work on core, and extended technology pieces

· Users who are conditioned to try products, both as consumers and enterprise customers

Lack of Mature Applications

It takes time for new applications to emerge when new foundational technology enters the scene. It took a long time before we were able to see ambitious and innovative Web applications, and many of the early ones were not that innovative, because they tried to replicate what was being done already in the real world. Nonetheless, replication is a good first step, because it allows one to gain experience when expectations are lower.

Taken as an extreme case, just about any software application could be rewritten with some blockchain and decentralization flavor into it, but that does not mean it’s a good idea to do so.

Perhaps 2016 for blockchain is equivalent to 1995 in terms of where we were at that stage with the proliferation of Web applications. At that time, the Java Virtual Machine was not yet available, but when it was, it opened an avalanche of opportunities, and made it easier to create large scale Web applications. The advent of the Java computer programming language meant that Java applications could run on any Java Virtual Machine (JVM) regardless of computer architecture. Some blockchains such as Ethereum have a similar “virtual machine” capability, which allows programs to execute on the blockchain without requiring developers to be aware of the inherent computer architecture.

Another blockchain criticism is the lack of so-called “killer apps” that are supposed to light-up exponential usage among consumers. We will certainly expect visible applications as beacons to others, but there is another point of view supporting the case for several killer apps, not just one. For that later scenario, the proverbial “long tail” market characteristics would prevail.

Scarcity in Developers

Several thousands of software developers will be needed to lift all the boats. By mid-2016, there were approximately 5,000 developers dedicated to writing software for cryptocurrency, Bitcoin, or blockchains in general.2 Perhaps another 20,000 had dabbled with some of that technology, or written front-end applications that connect to a blockchain, one way or the other. These numbers pale in comparison to 9 million worldwide Java developers (2016),3 and about 18.5 million software developers in the world (2014).4

Luckily, blockchains are programmed with languages and scripts that are similar to already popular ones, such as Java, Javascript, C++, Node.js, Python, Golang, or Haskell.5 This type of familiarity is a positive characteristic that will benefit programmers when they start to interact with blockchain technologies.

What will help improve the number of developers?

· More general market awareness about the blockchain to drive higher levels of interests.

· Popularity of certification programs, such as from the CryptoCurrency Certification Consortium (C4).6

· Availability of formal academic degrees that specialize in this field, such as the Master of Science in Digital Currency, offered by the University of Nicosia in Cyprus.

· Training programs by the blockchain providers.

Immature Middleware and Tools

Blockchain middleware and software tools are really important. The middleware is like the glue between blockchain infrastructure and the building of applications. Software development tools facilitate the overall software development projects.

Up until 1998, writing Web applications was not that easy, and required the manual assembly of several pieces of software together. During that time, several shortcomings plagued the deployment of Web applications, including the lack of robust transaction management and state related capabilities, scalability, deployment, applications manageability, and certainly security. Then, Netscape introduced the famous all-in-one “Netscape Application Server,” an integrated suite of software capabilities that included the various requirement components and tools, out-of-the-box. That simplification was a boon for programmers who took to it like ducks to water, and started focusing on writing Web applications, instead of worrying about assembling the required pieces together and about incompatibilities. Those early Netscape days denoted the beginning of the modern Web applications architecture era, which continues up to this point.

As soon we start to see complete, out-of-the-box products that promise to simplify how to start, develop, and deploy blockchain applications, we will know that a new phase has started.

Scalability

Scalability of blockchains is an issue that will continue to be debated, especially pertaining to the public Bitcoin blockchain. The challenge behind scalability is two-fold:

1. There is typically more than a single way to scale any technology, and the blockchain is no different. Several engineers may not agree on the best method to scale something, a situation that may result in long discussions and implementation delays.

2. As of 2016, some aspects of blockchain scalability still require ongoing scientific research, because this new territory is closer to the edges of a new frontier.

Scaling technical systems is a never-ending challenge. It is a moving target, because the needs for scale evolve as you grow; therefore you do not need to solve a problem you do not have yet. You typically solve it, just ahead of being hit with a problem, at the right time. You do not design a solution for 1 million users, when you are still only serving the first 1,000.

For reference, more than 30 years after its initial invention, we are still designing and refining the Internet’s own scalability. Eyeing 50 billion nodes in 2020 was not a design issue in 1983 or 1995. But now, the size of the network has grown significantly, and we have crossed a few billions users, we can more easily tackle the next scalability targets.

Scaling blockchains will not be different than the way we have continued to scale the Internet, conceptually speaking. There are plenty of smart engineers, scientists, researchers, and designers who are up to the challenge and will tackle it.

What complicates the scalability of blockchains even further is the required balance that needs to be preserved between decentralization and security. Scaling a decentralized network with an economic model that is tied to its security is a new frontier that has not been attempted before.

Legacy Systems

Typically, there are two issues relating to enterprise legacy systems:

1. Integration with existing applications.

2. Knowing what pieces to replace.

Technical integration with legacy or other applications will always be an IT implementation challenge. Therefore, it might be easier to develop use cases and projects outside of your existing systems, because you will avoid the integration nightmare, at least initially.

Tradeoffs with Databases

Understanding the tradeoffs and wise choices involving databases and blockchains is a key competency that needs to be perfected. It starts with a clear understanding of the strengths and weaknesses of each approach (see Chapters 1 and 2).

Finding the right balance between what a blockchain is particularly good at, and marrying the derived benefits with back-end databases or existing applications is part of the magic that you need to continuously seek out. We are still learning what these boundaries are, and like the pendulum, we might swing excessively toward one side, then to another before finding a middleground.

Along with that topic is the issue of storing blockchain data for transactional, historical, analytical, and compliance reporting requirements.

Privacy

In a public blockchain, the default mode for any transaction’s visibility is openness and transparency. This means that anyone can trace the path of a transaction including the value it holds, and its originating and destination address. That level of transparency was a non-starter in private blockchain implementations. However, it is now possible to achieve confidentiality in transactions by encrypting the values, and it is also possible to hide the identities via zero-knowledge proof schemes.

Security

The issue of blockchain security will be an everlasting one. We are still getting used to transaction finality by consensus (no matter what the form of consensus is), instead of a “database commit” which is a more deterministic method.

Large organizations, especially banks, have not been particularly interested in adopting public blockchains for their internal needs, citing potential security issues. The technical argument against the full security of public blockchains can easily be made the minute you introduce a shadow of a doubt on a potential scenario that might wreak havoc with the finality of a transaction. That alone is enough fear to form a deterring factor for staying away from public blockchain, although the argument could be made in favor of their security.

Lack of Standards

There is an old adage: the good thing about standards is there are so many of them to choose from. In its early days, blockchain technology suffers from the opposite problem.

Standards arrive in two ways, typically. They either become de facto standards by virtue of market adoption, or they are developed and agreed upon a priori, by a standards committee, or a consortium group.

Standards bring with them a number of benefits, including some network effects, easier interoperability, shared implementation knowledge, potential lower costs, and less overall risk. Standards can tackle different layers, targeting technical, platform or process-related areas.

But here is a warning on standards. You do not generally compete on standards. They tend to level the playing field, and allow companies to compete on their own terms through the way in which they implement these standards. Your competitive edge might come from the speed of your implementation, or your ability to innovate beyond these standards. The blockchain will present the same opportunities and caveats for standards use. Standards will be necessary, but not sufficient.

MARKET/BUSINESS CHALLENGES

Some of the market and business challenges are macro-related, while others are more organization-specific.

Moving assets to the blockchain

The blockchain is a super fast rail that moves digital assets. But, the first challenge relates to placing the train on the rails before it can start moving swiftly. You can either create new assets directly on the blockchain, or move existing ones to it. Each approach introduces different considerations, although it may be easier to start by creating native assets, because you do not have to worry about full integration with your existing systems until later on.

Quality of Project Ideas

First experiences count, but if your initial entry points do not seem to provide a visible return, maybe the quality and ambition level of these projects are at fault. If the projects are timid, so will be the returns.

Critical Mass of Users

This applies to both consumer and business-to-business markets. Many consumer applications require hundreds of thousands, if not millions of users to be considered successful. On the business-to-business side, you need to get all members of a value chain aligned and involved along a given blockchain before they can start to reap commensurate value, and it takes time to accomplish these types of commitments.

Quality of Startups

Blockchain startups are not different from tech startups. They will come in all types of quality variety, and only a few of them break out into successfully viable businesses. Having many startups is a sign of ecosystem vibrancy, even if 90-95% of them do not succeed. Even failed startups produce experienced entrepreneurs who are more seasoned as a result of their work, and it makes them better at their craft the next time around. We should celebrate the availability of startups, regardless of the initial quality factor of every new venture.

Venture Capital

The availability of venture capital is essential for funding the incubation, production, and acceleration of innovation around the application of blockchain technology. Professional venture capitalists are well versed in funding risk and supporting entrepreneurs to help them realize their goals. We should expect a gradual increase in venture funding that flows into blockchain startups, and that would be a healthy sign.

In addition to venture capital, crowdfunding by self-issuing cryptocurrency or crypto-tokens is also another funding option. This approach carries some risks and uncertainty, due to lower external accountability controls. Although viable for certain cases, the success rates are not better than venture capital-funded startups.

Volatility of Cryptocurrency

Cryptocurrency volatility is a usage and confidence deterrent, but it is expected that volatility will gradually stabilize, tracking the increasing maturity and market adoption of the underlying technology behind each cryptocurrency. Eventually, bad actors and speculators will progressively become an insignificant minority with little to no impact on the overall health of cryptocurrencies.

Onboarding New Users

Most users cannot handle increased usage complexity, especially when the underlying technology is complex (the blockchain). Early blockchain applications may not have the best user experiences, but eventually, a user may not even know there is a blockchain behind their usage.

Few Poster Applications Companies

Where are the Amazons and eBays of the blockchain? Those kinds of companies become reference points and archetype models because they are the first proof points that you can build a viable business on the blockchain. We will need to witness the emergence of such companies, and see their success materialize through market adoption.

Not Enough Qualified Individuals Within Companies

It takes a while to convert thousands of employees to become experienced blockchain advocates. A critical mass of internal supporters and experts is also required inside organizations, so they can fuel a variety of blockchain experiments and create solutions themselves, without permission, just as Web applications and ideas have finally become second nature to most enterprises.

Costs Issues

It is not expensive to start dabbling with blockchain technology because much of it is free via open source licensing. However, full implementation will bear additional costs, not unlike the costs of typical information technology-related projects and deployments. Some Chief Information Officers (CIOs) may be reluctant to add to their tight budgets, until early returns on investment have been demonstrated.

Innovators Dilemma

It is difficult to innovate within your business model, because you will typically attempt to tie everything back to it, resulting in a shortsighted and limited view of what is possible. This is especially true if your business has a trust-related function (such as a clearinghouse). Current intermediaries will encounter the hardest change, because the blockchain hits at the core of their value proposition. They will need to be creative, and dare disrupting themselves while folding some blockchain capabilities under their offerings, and creatively developing new value proposition elements. They will need to realize that it is better to shoot yourself in the foot, rather than to have someone else shoot you in the head. This will not be an easy transition, because changing business models could be difficult to achieve in large organizations for a variety of factors.

LEGAL /REGULATORY BARRIERS

Generally speaking, regulators and policy makers react in three different ways when faced with new technology:

1. Do nothing, and let the market mature and evolve on its own.

2. Control the choke points. For example, these choke points might be the cryptocurrency exchanges or software providers who will be required to get licensed.

3. Insert automatic regulation at the point of transaction, or somewhere during its journey. This might involve making room for the availability of direct data reporting via a backdoor, an information exhaust pipe, or a direct deduction on a transaction.

Unclear Regulations

As long as the position of regulators is not clarified, confusion and uncertainty will continue to exist for everyone involved in the blockchain space. The blockchain is a blockbuster technology that affects so many areas, and it is likely that different flavors of regulation will come at it from a variety of directions. This might add to the confusion. Just as the Internet was left alone to blossom in its earlier years, it would be advisable that blockchain technology is left alone until it matures further.

Regulation will eventually come to blockchains, but better late than early. A fundamental paradigm shift that regulators will need to come to grips with is that trust is now more open, and “free from central controls” who they typically regulated. The nature of trust is changing, but regulators are used to regulating the “trust providers.” Will they learn to adjust when the trust provider is a blockchain, or a new type of intermediary that didn’t fit the previous model of central choke point regulation? Specifically, the blockchain is decentralized by default, so it’s more difficult to regulate decentralized entities than central ones. Therefore, we will need to see innovation in regulations. Maybe blockchains can get certified for example.

It is noteworthy that we are still regulating some aspects of cars more than one hundred years after they were invented, for example, by requiring lights to be turned on during the day, mandating seat belts, or limiting carbon dioxide emission levels. These regulations were certainly not part of the initial years of the automobile industry, but they were thought of after years of observation and experience. Imagine if regulators demanded automatic daylight sensors or inflatable air bags in 1910, two years following the Ford Model T introduction. Not only were these needs not thought of; even the basic technology behind these capabilities wasn’t yet invented. The lesson here is that we do not really know what we need to regulate when a new technology is in its infancy of adoption.

Government Interferences

Targeting Bitcoin primarily, several governments did not feel comfortable with a currency that was not backed by a sovereign country’s institutions. Some countries and central banks issued official warnings against Bitcoin usage during its early years, including Russia, China, and the European Union. Blockchains are not Bitcoin, yet they allow the creation and distribution of cryptocurrency, as well as assets with real value. The operations of blockchains will continue to be the subject of government scrutiny until politicians and policy makers feel more comfortable with their usage.

Governments can send the wrong signals to the market, to policy makers, and to law enforcement agencies, who are typically proxies to them. In addition, heavy-handed government actions risk short-circuiting the private sector leadership in blockchain technology, which is known to bear the fruit of innovation. Of course, government regulation may be applicable for consumer protection and certain other level of standards, but early interference will generally not be helpful.

Compliance Requirements

Compliance is an important activity, especially for financial services providers who spend billions of dollars annually, in order to stay up to the date on the latest laws and regulations.

Compliance and non-compliance are both costly, amounting to overhead that eats into profit margins. Some areas where compliance could offer breakthroughs might include:

· Accepting cryptocurrency-backed tokens as real value.

· Recognizing the finality of transactions that have passed through a blockchain.

· Allowing the necessary legal linkages to smart contracts.

· Permitting peer-to-peer counterparty validations via the blockchain.

Hype

It is difficult to characterize or agree on what constitutes hype or not. Sometimes the perception of hype is as damaging as hype itself. Excessive periods of hype are detrimental to the propagation of new technology, although markets almost always overshoot with hype expectations before pulling back into reality, and then they proceed accordingly. A most common form of hype typically comes from technology providers who are overzealous in their marketing approaches.

Taxation and Reporting

Early blockchain platforms were focused on transactions, and not reporting. However, these platforms will need better taxation and reporting capabilities so that their output can be fed into traditional accounting systems. There will be solutions that address this sector.

BEHAVIORAL/EDUCATIONAL CHALLENGES

Lack of Understanding of Potential Value

A lack of a comprehensive understanding of the basic capabilities surrounding the blockchain will deter any smart executive from seeing the fullness of its potential value. This challenge will be only solved via a concerted effort to get educated about the blockchain and its potential. This was my impetus for my writing The Business Blockchain.

Limited Executive Vision

Some executives will just see what they want to see, either because they have not spent enough time to fully study the blockchain, or perhaps they are afraid of learning it to avoid handling the disruption potential on their business. It does take some time to fully wrap your mind around the many possibilities of the blockchain. Executives with a fear of the blockchain will dial down their vision to fit their own reality, which is typically painted in restrictive colors.

Change management

The blockchain is about business process reengineering—at least, if you want to reap more fundamental benefits. Quick or easy projects may not have the depth of required change that is needed to yield more gains. Change is hard to accomplish in large organizations.

Trusting a Network

Blockchain skeptics might think: we already trust one another, and we have century old institutions that perform that kind of trust, so why do we need to put trust inside a network?

Trusting a network of computers that perform mathematical computations instead of a “known, trusted” party that you can see requires a new mental paradigm that we are not used to. Eventually, we will come to grips with the fact that the trust is in the network—and it is a new form of trust. Let us remember that Internet payments were not completely trusted during the early Web years (1994-1998), at least not by the banks. We had to go through special “payment gateways” that were set-up specifically to perform that trust function while dissociating them from the banking systems who didn’t want to touch untrusted technology. Soon enough, paying on the Web with a credit card became wildly accepted, and most current Web users will probably not remember these early days of trepidation and fear, although the similarity with trusting blockchains is strikingly familiar.

As much as we will initially fret over the availability of blockchains as trust services delivery networks, they will be eventually be taken for granted, just as Internet access is taken for granted today in most parts of the world.

Few Best Practices

Given the scarcity of Blockchain implementation experiences, the real best practices are few and far between. Following the initial fury towards the discovery of use cases, sharing best practices and benchmarking will be the next popular activity.

Low Usability Factor

Bitcoin’s original usability was not so great, as reflected by the dozens of software wallet applications that sprung out since 2010. Web-based hosted cryptocurrency exchanges provided an easier user interface, via an online banking-like familiar look and feel. Although the latter were criticized for a lack of decentralization, they did offer a desirable ease of use that spurred user adoption.

The next generation of blockchain-based applications will come in two flavors: either they will be decentralized applications (like OpenBazaar), or they will look like regular Web applications with back-end decentralization. In either case, their usability will be intricately tied to the specific function they are addressing. For example, it will be a financial trade application, or a land registration application, and the blockchain will do its work without being overly visible to the user, except in allowing them to reap the benefits they bring.

KEY IDEAS FROM CHAPTER THREE

1. The list of challenges facing the blockchain is long, but there is not a lot of difference with the Internet’s situation, back in 1997, when we knocked down all these barriers one by one, while some of them went away on their own.

2. There are technical, business/market, legal/regulatory, and behavioral/educational challenges to the blockchain’s evolution.

3. Some of the most important challenges include scalability (technical), innovation (business), trusting a network (behavioral), and modern regulation (legal).

4. Just as we continued to scale the Internet 30 years after its invention, we will continue to solve and update the blockchain’s scalability needs.

5. Just as we continued to update automobile safety regulations in ways that were unforeseen during the invention moment, we will continue to update the regulatory requirements around the blockchain over the lifetime of its evolution.

NOTES

1. A term popularized in Clayton Christensen’s book (The Innovator’s Dilemma) suggesting that successful companies can put too much emphasis on customers’ current needs, and fail to adopt new technology or business models, https://en.wikipedia.org/wiki/The_Innovator%27s_Dilemma. List of U.S. executive branch czars, https://en.wikipedia.org/wiki/List_of_U.S._executive_branch_czars.2. Source: Author’s sample survey of market leaders, April 2016.3. Java, https://en.wikipedia.org/wiki/Java_%28programming_language%29.4. IDC Study, http://www.infoq.com/news/2014/01/IDC-software-developers.5. These are popular programming languages.6. https://cryptoconsortium.org/