Bookkeeping & Accounting All-in-One For Dummies (2015)

Book II

Bookkeeping Day to Day

Head online and visit www.dummies.com/extras/bookkeepingaccountingaio for some free bonus articles.

Head online and visit www.dummies.com/extras/bookkeepingaccountingaio for some free bonus articles.

In this book …

· Know what tasks you need to carry out on a day-to-day basis to ensure that you’re keeping accurate records.

· Make a checklist to help you undertake all the activities necessary for keeping your business finances running smoothly.

· Discover how you should record sales transactions, including dealing with returns and discounts.

· Manage the purchasing function within your business including stock management.

· Learn how to manage and reconcile your bank accounts.

Chapter 1

Planning and Controlling Your Workload

In This Chapter

![]() Using checklists

Using checklists

![]() Filing and processing your sales and purchases invoices

Filing and processing your sales and purchases invoices

![]() Entering your banking transactions

Entering your banking transactions

![]() Reconciling your bank account

Reconciling your bank account

![]() Tackling month-end journals

Tackling month-end journals

![]() Setting up systems and controls for your business

Setting up systems and controls for your business

![]() Separating duties

Separating duties

As a bookkeeper, you need to work in an orderly manner and be aware of which jobs need doing on a daily, weekly and monthly basis, which is why checklists are so useful. You need to do certain jobs on a daily basis, depending on the size of your business; for example, entering invoices. Other jobs are done on a monthly basis, such as reconciling your bank account. Most businesses receive only one statement once a month and wait until they’ve received it before they reconcile their bank account.

As the company bookkeeper, you should analyse all the jobs that require completing and decide on an appropriate order in which to conduct those tasks. You then need to allocate the work to the appropriate person or department, so that everyone in the office is aware of what responsibilities they have. If your business is so small that you’re the only person in it, you have to do everything. Nothing like hands-on experience!

This chapter offers hints and tips to help you process your transactions in an efficient manner.

Introducing Checklists

Having a list of all the jobs that need to be carried out in a month is always a good idea. That way, you know what you’re working towards. In bookkeeping, the number of transactions that you deal with varies massively from company to company. You’re reacting both to the number of invoices that a business generates itself for customers and to the invoices that it receives from its suppliers. Every business differs in the number of invoices that it handles.

Some businesses have entire departments that process just invoices. For example, you may have a department that processes just purchase invoices. The business may receive so many that you have purchase journal clerks who only process and write up purchase invoices. The bigger your company, the more likely you are to use a computerised accounting system. However, whether you use computers or not, you still benefit from using checklists to guide you through the monthly bookkeeping routine.

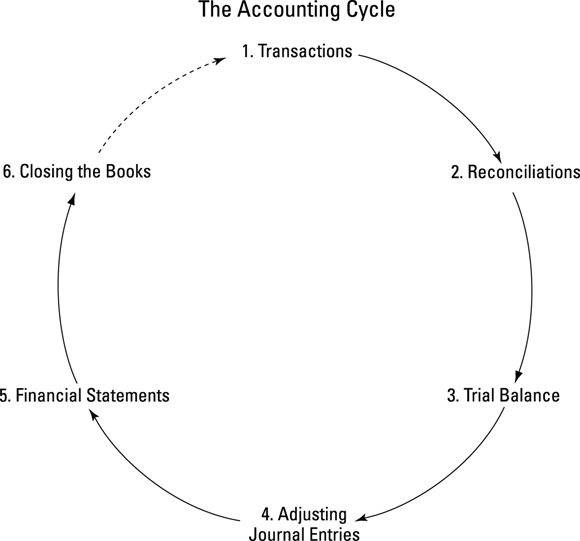

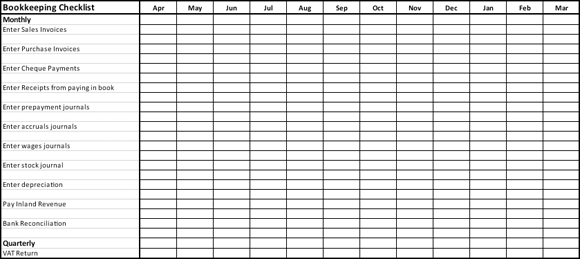

Figure 1-1 is an example of a checklist that we use on a monthly basis.

Figure 1-1: An example of a monthly bookkeeping checklist.

Sorting Out Your Sales Invoices

If your business produces sales invoices for customers who are buying on credit, read on! Your business may produce these invoices by hand, a word processor or a computerised system. We talk about cash sales and computer-generated invoices in Book II Chapter 2. Here we discuss the filing and management of those invoices after they’ve been produced.

Referring to the checklist shown in Figure 1-1, you can see that the first job on the list is entering sales invoices. Make sure that the person who produces the sales invoices puts them somewhere you can easily find them, for example, an in-tray simply for sales invoices or a concertina-style file that invoices are kept in prior to you entering them into your bookkeeping system.

If you have a computerised system that produces sales invoices automatically, you can skip this step, as the computer produces those invoices automatically and the Sales journal updated accordingly, as detailed in Book II Chapter 2.

You should find that each sales invoice has already been given an invoice number. Adopt a sequential numbering system that allows you to notice whether invoices have been missed or not. The invoice numbers can be alpha-numeric if it helps with your business, but the invoices should be filed in numerical order, so that you file and enter them into your bookkeeping system in roughly chronological order.

As you enter each invoice into your Sales Ledger, tick or mark the invoice in some way to indicate that you’ve posted it into your bookkeeping system so you avoid entering the same invoice twice.

As you enter each invoice into your Sales Ledger, tick or mark the invoice in some way to indicate that you’ve posted it into your bookkeeping system so you avoid entering the same invoice twice.

File your invoices neatly in a lever arch file.

Entering Your Purchases Invoices

You receive purchase invoices in the post on an almost daily basis. Whoever opens the post needs to know where to put those invoices until it is time to enter them into the bookkeeping system. Again, as with the sales invoices, keep the purchase invoices in one dedicated place until you’re ready to enter them into your Purchase Ledger.

Sequential numbering and coding

Some companies like to keep a separate lever arch file for each supplier, or at least file the invoices in supplier order. Others simply number the purchase invoices sequentially with a stamping machine and use this number within the bookkeeping system. Using this method, you can file all your purchase invoices in one file and just keep them in numerical order.

When you enter the invoice into the bookkeeping system, you need to know which nominal code to apply in order to enter the invoice. It may not be immediately obvious what the invoice is for. For example, as a bookkeeper, you need to know whether the invoice relates to a direct cost of the business or whether it is simply an overhead of the business.

Some companies use a data-entry stamp, which has spaces to enter vital information such as the date the invoice was posted, nominal code and maybe a space for the data-entry clerk to initial, to confirm that the transaction has been entered.

You may find that you’re entering invoices on a daily basis. When you begin to enter invoices at the start of each day, check your bookkeeping system to see what the last invoice entered was. You can check the last invoice number used and then you know which invoice number to start with when you enter your next invoice.

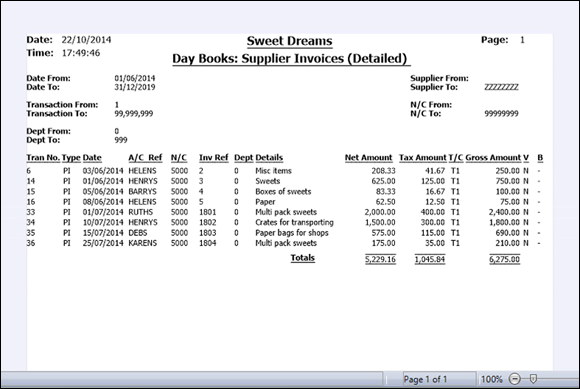

If you’re using a computerised system such as Sage 50 Accounts, you can check the Purchase Daybook. See Figure 1-2 for an example of the report you can run to check the last purchase invoice entered.

Figure 1-2: Check your Purchase Daybook to see the last invoice entered.

Notice the ‘Invoice Reference’ column. This column is where the sequential purchases invoice number appears.

Paying your suppliers

Although we don’t include this task on the checklist, paying your suppliers on time is vital to any business. Flip to Book II Chapter 3 to see just why!

You may decide to pay your suppliers at specific times in the month, so add this task to your monthly bookkeeping routine.

Checking Cash Payments and Receipts

In Book II Chapter 4, we discuss the importance of ensuring that all banking entries are included in your bookkeeping system, particularly when you need to reconcile your bank account. In this chapter, we discuss the practical ways to ensure that you include all your data in your system.

Cash payments

Most businesses make payments in several ways. Cash payments include:

· Cash (naturally!) - usually from the petty cash tin

· Cheque

· Bank transfer, CHAPS or BACS, or another form of electronic payment

As a bookkeeper, make sure that you collect all the payment information from all the relevant sources. The bank reconciliation process highlighted in Book II, Chapter 4 ensures that you do this; however, here are a few more practical tips to make the reconciliation process as simple as possible.

An easy way to ensure that you’ve entered all your petty cash payments is to physically tick or initial the petty cash voucher or cash receipt after entering it into your bookkeeping system. You then avoid entering items twice. You can batch up your petty cash payments and give them a batch reference so that they can be easily retrieved from your filing system.

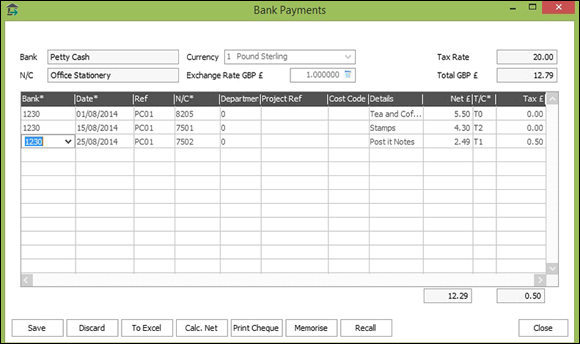

Look at Figure 1-3 to see an example of a batch entry of petty cash receipts being posted onto Sage 50 Accounts. The batch of receipts has been given the reference PC01. A separate bank account has been set up called Petty Cash.

© Sage (UK) Limited. All rights reserved.

Figure 1-3: Petty cash payment showing PC01 as a batch reference.

To make life as easy as possible, when you write out cheques, ensure that you include clear information about who you’re paying on the cheque stub. Don’t attempt to write War and Peace here, but include the date, the payee and the amount. Write this information clearly, especially if it may not be you that ultimately writes up the Cash Payments book or enters the amount into your computerised accounting system. If you’ve spidery handwriting, spare a thought for the person who needs to read this information! Entering wrong amounts or the wrong account leads to problems when trying to reconcile the bank account.

To make life as easy as possible, when you write out cheques, ensure that you include clear information about who you’re paying on the cheque stub. Don’t attempt to write War and Peace here, but include the date, the payee and the amount. Write this information clearly, especially if it may not be you that ultimately writes up the Cash Payments book or enters the amount into your computerised accounting system. If you’ve spidery handwriting, spare a thought for the person who needs to read this information! Entering wrong amounts or the wrong account leads to problems when trying to reconcile the bank account.

At some point, you enter the information written on the cheque stub into the bookkeeping system. After you write the information up in your Cash Payments book or enter it onto your computing system, make sure that you physically tick the cheque stub. This way, you know that you’ve entered that information, and can easily flick through the cheque stubs at a later date and find where you last entered information.

You won’t be aware of what electronic payments have been made until you see the bank statements for the month. Most businesses don’t receive the previous month’s statements until the end of the first week of the following month. For most businesses, this timing is impractical, so with the advent of Internet banking, most businesses can print out copies of their bank statements on a daily basis if necessary. Therefore you can reconcile your bank account on a much more regular basis than simply once a month, which was the traditional way. You can also identify your electronic payments sooner and enter them accordingly.

Again, an easy way to ensure that you’re entering the information correctly is to physically tick the transaction on your copy of the bank statement.

Avoid printing too many copies of your bank statements, because doing so can lead to mistakes happening, with the same information entered twice.

Avoid printing too many copies of your bank statements, because doing so can lead to mistakes happening, with the same information entered twice.

Cash receipts

These transactions include:

· Items physically paid in at the bank via the paying-in book

· Electronic receipts via BACS and other electronic methods, including interest earned on the bank account

For items paid in using the paying-in book, make sure that you include as much detail as possible. If you can, include the invoice numbers that the customer is paying, so that you can easily allocate the receipt to the correct invoices. Knowing which invoices the customer is paying is crucial so that the Aged Debtor report is correct. (See Book II, Chapter 2 for more on Aged Debtor reports.)

After you’ve entered the information from your bank paying-in slips to your bookkeeping system, tick the stub to show that the information’s been entered, so you can see at a glance where you’re up to.

Reconciling Your Bank Account

Reconciling your bank account to check that your manual or computerised Cashbook matches your bank statement is usually part of your monthly accounting process. Book II, Chapter 4 shows you how to carry out the reconciliation process both manually and using computer software. Make sure that you reconcile your bank accounts, because this reconciliation ensures the accuracy of the information that has been posted to your accounting system. You should also reconcile any credit card statements that you’ve received; by doing this, you accurately record credit card liabilities that the business may have incurred.

Entering Your Journals

Monthly journals always need to be completed. If you refer back to the checklist shown in Figure 1-1, we refer to prepayments, accruals, wages, stock and depreciation. Your business may have some or all these journals, but you may also have additional ones that are specific to your business. Ensure that all the journals that you need to process are on your checklist so that they aren’t missed out.

For more information on Accruals, Prepayments, Depreciation and Stock journals, see Book III, Chapter 3.

Controlling Your Books, Records and Money

Cash is an extremely important part of any business and you need to accurately record and monitor it. Before you take in any money, you must be sure that systems are in place to control the flow of cash in and out of the business.

Here are some tips:

· Initially, when your business is small, you can sign each cheque and keep control of the outflow of money. But as the business grows, you may find that you need to delegate cheque-signing responsibilities to someone else, especially if you travel frequently.

Many small business owners set up cheque-signing procedures that allow one or two of their staff to sign cheques up to a designated amount, such as £5,000. Any cheques above that designated amount require the owner’s signature, or the signature of an employee and a second designated person, such as an officer of the business.

· A good practice is to record cheques received immediately as part of a daily morning routine. Enter the details onto the paying-in slip and update your computerised or manual accounting system at the same time. Make sure that you pay in any money received before 3:30 p.m. on the same day, to ensure that your bank account gets credit that day rather than the next.

· No matter how much you keep in petty cash, make sure that you set up a good control system that requires anyone who uses the cash to write a petty cash voucher specifying how much was used and why. Also ask that a cash receipt, for example from the shop or post office, is attached to the voucher in order to justify the cash withdrawal whenever possible.

In most cases, a member of staff buys something for the business and then gets reimbursed for that expense. If the expense is small enough, you can reimburse through the petty cash fund. If the expense is more than a few pounds, ask the person to fill out an expense account form and get reimbursed by cheque. Petty cash is usually used for minor expenses of £10 or less.

· The best way to control petty cash is to pick one person in the office to manage the use of all petty cash. Before you give that person more cash, he should be able to prove the absence of cash used and why it was used.

Dividing staff responsibilities

Your primary protection against financial crime is properly separating staff responsibilities when the flow of business cash is involved. In a nutshell, never have one person handling more than one of the following tasks:

· Bookkeeping: Involves reviewing and entering all transactions into the business’s books. The bookkeeper makes sure that transactions are accurate, valid and appropriate, and have the proper authorisation. For example, if a transaction requires paying a supplier, the bookkeeper makes sure that the charges are accurate and someone with proper authority has approved the payment. The bookkeeper can review documentation of cash receipts and the overnight deposits taken to the bank, but shouldn’t actually make the deposit.

Also, if the bookkeeper is responsible for handling payments from external parties, such as customers or suppliers, he shouldn’t enter those transactions in the books.

· Authorisation: Involves being the manager or managers delegated to authorise expenditures for their departments. You may decide that transactions over a certain amount must have two or more authorisations before cheques can be sent to pay a bill. Spell out authorisation levels clearly and make sure that everyone follows them, even the owner or managing director of the business. (Remember, if you’re the owner, you set the tone for how the rest of the office operates; when you take shortcuts, you set a bad example and undermine the system you put in place.)

· Money-handling: Involves direct contact with incoming cash or revenue, whether cheque, credit card or credit transactions, as well as outgoing cash flow. People who handle money directly, such as cashiers, shouldn’t also prepare and make bank deposits. Likewise, the person writing cheques to pay business bills shouldn’t be authorised to sign those cheques; to be safe, have one person prepare the cheques based on authorised documentation and a second person sign those cheques, after reviewing the authorised documentation.

When setting up your cash-handling systems, try to think like an embezzler to figure out how someone can take advantage of a system.

When setting up your cash-handling systems, try to think like an embezzler to figure out how someone can take advantage of a system.

· Financial report preparation and analysis: Involves the actual preparation of the financial reports and any analysis of those reports. Someone who’s not involved in the day-to-day entering of transactions in the books needs to prepare the financial reports. For most small businesses, the bookkeeper turns over the raw reports from the computerised accounting system to an outside accountant who reviews the materials and prepares the financial reports. In addition, the accountant does a financial analysis of the business activity results for the previous accounting period.

We realise that you may be just starting up a small business and therefore not have enough staff to separate all these duties. Until you do have that capability, make sure that you stay heavily involved in the inflow and outflow of cash in your business. At least once a month:

We realise that you may be just starting up a small business and therefore not have enough staff to separate all these duties. Until you do have that capability, make sure that you stay heavily involved in the inflow and outflow of cash in your business. At least once a month:

· Open your business’s bank statements and review the transactions. Someone else can be given the responsibility of reconciling the statement, but you still need to keep an eye on the transactions listed.

· Look at your business cheque book counterfoils to ensure that no cheques are missing. A bookkeeper who knows that you periodically check the books is less likely to find an opportunity for theft or embezzlement. If you find that a cheque or page of cheques is missing, act quickly to find out whether the cheques were used legitimately. If you can’t find the answer, call your bank and put a stop on the missing cheque numbers.

· Observe your cashiers and managers handling cash to make sure that they’re following the rules you’ve established. This practice is known as management by walking around - the more often you’re out there, the less likely you are to be a victim of employee theft and fraud.

Balancing control costs

As a small-business owner, you’re always trying to balance the cost of protecting your cash and assets with the cost of adequately separating those duties. Putting in place too many controls, which end up costing you money, can be a big mistake.

For example, you may create stock controls that require salespeople to contact one particular person who has the key to your product warehouse. This kind of control may prevent employee theft, but can also result in lost sales, because salespeople can’t find the key-holder while dealing with an interested customer. In the end, the customer gets mad, and you lose the sale.

When you put controls in place, talk to your staff both before and after instituting the controls to see how they’re working and to check for any unforeseen problems. Be willing and able to adjust your controls to balance the business needs of selling your products, managing the cash flow and keeping your eye on making a profit. Talk to other businesspeople to see what they do and pick up tips from established best practice. Your external accountant can be a good source of valuable information.

When you put controls in place, talk to your staff both before and after instituting the controls to see how they’re working and to check for any unforeseen problems. Be willing and able to adjust your controls to balance the business needs of selling your products, managing the cash flow and keeping your eye on making a profit. Talk to other businesspeople to see what they do and pick up tips from established best practice. Your external accountant can be a good source of valuable information.

Have a Go

Grab a pencil and some paper and test your knowledge on the best way of working as a bookkeeper.

1. You work in the accounts department for a small business. Write a procedure for a new member of staff to follow, which shows him what to do when a cheque arrives by post into the business.

Consider who opens the post, who writes up the paying-in book and who ultimately takes the cheques to the bank. Try to remember that these responsibilities should be split up as much as possible to minimise any possibility of fraud.

2. Review your petty cash procedure.

Decide who is responsible for maintaining the petty cash tin, and how much the petty cash float is going to be. Make sure that all staff are aware of the petty cash procedure.

3. Imagine that you’re setting up the accounting department. Jot down the types of tasks that require separation of duties.

Answering the Have a Go Questions

1. The following is an example of what you may have written.

Procedure for banking cheques:

· The person responsible for opening the post should ensure that all cheques and notifications of payments from customers (for example, a remittance advice) are passed to the accounts department on the day that they’re received.

· One person in the accounts department should be responsible for writing up the bank paying-in book and recording all the money received, along with details of the customer and which invoice they’re paying. As much detail as possible should be written on the paying-in slip stub.

· If possible, a different individual should ensure that the paying-in book is taken to the bank and the money deposited, the same day it is received.

· When the bank paying-in book has been returned to the accounts department, the customer receipts should be entered into your bookkeeping system. If you have a computerised system, you should enter the customer receipts against the appropriate account, using the bank paying-in reference and details shown on the paying-in book to identify which invoices the payment should be allocated to. Tick the paying-in slip when you’ve entered the information into your bookkeeping system.

2. Here are the main elements of a petty cash procedure:

· Designate a member of staff to be responsible for petty cash. Ensure that all members of staff know who this person is.

· Complete petty cash vouchers for all petty cash payments detailing the type of expenditure and noting VAT if applicable. Attach the receipts to the vouchers, so that VAT may be claimed at a later date.

· Ensure that the individual claiming money from petty cash signs the petty cash voucher to acknowledge receipt of the money and also ensure that the petty cashier authorises the payment by signing the voucher accordingly.

· Number each petty cash voucher so that it can be filed and easily located later if necessary.

· Write up the petty cash book, or enter the petty cash vouchers onto your computerised system, using the number mentioned in the last step as a reference.

· Petty cash should be counted and balanced on a regular basis. This task is usually done when the float needs topping up.

3. The following are the types of duties that you should consider separating among different members of staff.

Obviously, in a very small company this separation may not be possible, so let common sense prevail!

· The person who opens the post and accepts the cash should not enter the transaction in the books.

· The person who enters the data in the books on a daily basis should not prepare the financial statements.

· The person who prepares the cheques should not have the authority to sign the cheques.

· The person who pays the money into the bank should not be the person who completes the paying-in slips.