HBR’s 10 Must Reads (2015)

The Capitalist’s Dilemma

by Clayton M. Christensen and Derek van Bever

LIKE AN OLD MACHINE emitting a new and troubling sound that even the best mechanics can’t diagnose, the world economy continues its halting recovery from the 2008 recession. Look at what’s happening in the United States: Even today, 60 months after the scorekeepers declared the recession to be over, its economy is still grinding along, producing low growth and disappointing job numbers.

One phenomenon we’ve observed is that, despite historically low interest rates, corporations are sitting on massive amounts of cash and failing to invest in innovations that might foster growth. That got us thinking: What is causing that behavior? Are great opportunities in short supply, or are executives failing to recognize them? And how is this behavior pattern linked to overall economic sluggishness? What is holding growth back?

Most theories of growth are developed at the macroeconomic level—at 30,000 feet. That perspective is good for spotting correlations between innovation and growth. To understand what causes growth, however, you have to crawl inside companies—and inside the minds of the people who invest in and manage them. This article (which builds on a New York Times piece Clay wrote in late 2012) is an attempt to form a theory from the ground up, by looking at company experience.

About a year ago we invited the students and alumni of our Harvard Business School course “Building and Sustaining a Successful Enterprise”—who represent a cross-section of the corporate, entrepreneurial, and financial services sectors worldwide—to join us in this effort. (See “A New Approach to Research.”) Early on, we explored a wide range of reasons for the sputtering recovery, including political and economic uncertainty, the low rate of bank lending, a decline in publicly supported research in the United States, and the demise of innovation platforms like Bell Labs. (In “The Price of Wall Street’s Power” our colleague Gautam Mukunda contends that the finance sector’s growing power is a major factor.)

Fairly quickly, though, the discussion focused in on what had first attracted our attention: the choices companies make when they invest in innovation. Unlike some complicated macroeconomic factors, these choices are well within managers’ control.

We’re happy to report that we think we’ve figured out why managers are sitting on their hands, afraid to pursue what they see as risky innovations. We believe that such investments, viewed properly, would offer the surest path to profitable economic and job growth. In this article we advance some prescriptions that could become the basis of an agenda for meaningful progress in this area.

In our view the crux of the problem is that investments in different types of innovation affect economies (and companies) in very different ways—but are evaluated using the same (flawed) metrics. Specifically, financial markets—and companies themselves—use assessment metrics that make innovations that eliminate jobs more attractive than those that create jobs. We’ll argue that the reliance on those metrics is based on the outdated assumption that capital is, in George Gilder’s language, a “scarce resource” that should be conserved at all costs. But, as we will explain further, capital is no longer in short supply—witness the $1.6 trillion in cash on corporate balance sheets—and, if companies want to maximize returns on it, they must stop behaving as if it were. We would contend that the ability to attract talent, and the processes and resolve to deploy it against growth opportunities, are far harder to come by than cash. The tools businesses use to judge investments and their understanding of what is scarce and costly need to catch up with that new reality.

Idea in Brief

The Problem

What is the connection between slow growth in the U.S. economy and corporate reluctance to invest in market-creating innovations?

The Analysis

Investors and executives have been trained to think of capital as their scarcest resource—and this has led to unhelpful ways of assessing investment opportunities.

The Solution

We need new ways to measure potential and to define success.

Before we get to the solutions, let’s look more closely at the different types of innovation.

Three Kinds of Innovation

The seminal concepts of disruptive and sustaining innovations were developed by Clay as he was studying competition among companies. They relate to the process by which innovations become dominant in established markets and new entrants challenge incumbents. The focus of this article, however, is the outcome of innovations—their impact on growth. This shift requires us to categorize innovation in a slightly different way:

Performance-improving innovations replace old products with new and better models. They generally create few jobs because they’re substitutive: When customers buy the new product, they usually don’t buy the old product. When Toyota sells a Prius, the customer rarely buys a Camry too. Clay’s book The Innovator’s Solution characterized these as sustaining innovations, noting that the resource allocation processes of all successful incumbent firms are tuned to produce them repeatedly and consistently.

Efficiency innovations help companies make and sell mature, established products or services to the same customers at lower prices. Some of these innovations are what we have elsewhere called low-end disruptions, and they involve the creation of a new business model. Walmart was a low-end disrupter in retailing, for example, and Geico in insurance. Other innovations, such as Toyota’s just-in-time production system, are process improvements. Efficiency innovations play two important roles. First, they raise productivity, which is essential for maintaining competitiveness but has the painful side effect of eliminating jobs. Second, they free up capital for more-productive uses. Toyota’s production system, for example, allowed the automaker to operate with two months’—rather than two years’—worth of inventory on hand, which freed up massive amounts of cash.

A New Approach to Research

IN WRITING THIS ARTICLE, we asked students and alumni of our HBS course “Building and Sustaining a Successful Enterprise” to collaborate with us. This collaboration took place primarily on the OpenIDEO online platform, which Tom Hulme, one of our alumni, helped develop, and was made possible through the leadership of the HBS Digital Initiative under the direction of Karim Lakhani. This effort represents a first attempt to create a community of lifelong collaboration with HBS alumni. Where we have been given permission, we share some of the individual contributions in this article.

Market-creating innovations, our third category, transform complicated or costly products so radically that they create a new class of consumers, or a new market. Look at what has happened with computers: The mainframe computer cost hundreds of thousands of dollars and was available to a very small group. Then the personal computer brought the price down to $2,000, which made it available to millions of people in the developed world. In turn, the smartphone made a $200 computer available to billions of people throughout the world. We see this pattern so frequently that we’re tempted to offer it as an axiom: If only the skilled and the rich have access to a product or a service, then you can reasonably assume the existence of a market-creating opportunity.

Market-creating innovations have two critical ingredients. One is an enabling technology that drives down costs as volume grows. The other is a new business model allowing the innovator to reach people who have not been customers (often because they couldn’t afford the original product). Think of it like this: An efficiency innovation pointed in the right direction—toward turning nonconsumption into consumption—becomes a market-creating innovation. Ford’s Model T, for example, brought automobile ownership within reach for most Americans, because of both its simple design and the revolutionary assembly line that brought scale to the enterprise. In the same way, Texas Instruments and Hewlett-Packard used solid-state technology to bring low-cost calculators to millions of students and engineers worldwide.

Jobless recoveries

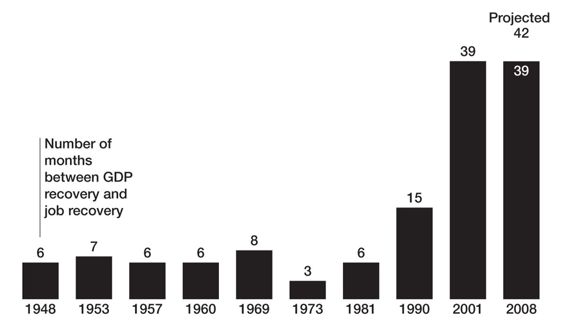

In the recessions the United States has experienced since 1948, the rebound in employment has typically lagged the rebound in GDP by about six months. Since 1990, though, the lag has been increasing dramatically. But with the latest recession, 39 months after GDP had returned to normal, employment still hadn’t caught up, and it was expected to lag for another two to three months.

Source: U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, McKinsey Global Institute Analysis

Companies that develop market-creating innovations usually generate new jobs internally. When more people can buy their products, they need more employees to build, distribute, sell, and support them. A great deal of related employment growth, though, occurs in the innovating companies’ supply chains or in partners whose own innovations help build a new platform. A classic example is the Bessemer Converter, patented in 1856, which made it possible to manufacture steel inexpensively for the first time. Andrew Carnegie used its revolutionary cost-reduction potential to build the Thomson Steel Works, but the railroad companies used the cheaper steel to create a new industry. U.S. steel employment quadrupled in the last quarter of the 19th century, reaching 180,000 by 1900, and railroad employment reached 1.8 million a scant two decades later.

The combination of a technology that drives down costs with the ambition to eradicate nonconsumption—to serve new customers who want to get something done—can have a revolutionary effect. A decade ago, Apple’s managers were on the lookout for a device that could enable convenient, affordable storage of a consumer’s music library, with anytime, anywhere access. They saw in Toshiba’s development of a 1.8-inch hard drive the opportunity to fulfill this job, which triggered the development of the iPod/iTunes business model. And if companies such as Corning and Global Crossing hadn’t innovated to create and lay ample low-cost dark fiber capacity, Google, Amazon, and Facebook wouldn’t exist as we know them today.

Market-creating innovations need capital to grow—sometimes a lot of capital. But they also create a lot of jobs, even though job generation is not an intended effect but a happy consequence. Efficiency innovations are at work 24/7 in every industry; that very same efficiency, if targeted toward making a product or a service more affordable and accessible, can create net new jobs, not eliminate them.

The mix of these types of innovation—performance-improving, efficiency, and market-creating—has a major impact on the job growth of nations, industries, and companies. The dials on the three types of innovation are sensitive, but if the capital that efficiency innovations liberate is invested in market-creating innovations at scale, the economy works quite well. However, that’s a big “if,” as we shall see.

The Orthodoxy of New Finance

So, to come back to our central question (phrased in a new way): Why do companies invest primarily in efficiency innovations, which eliminate jobs, rather than market-creating innovations, which generate them? A big part of the answer lies in an unexamined economic assumption. The assumption—which has risen almost to the level of a religion—is that corporate performance should be focused on, and measured by, how efficiently capital is used. This belief has an extraordinary impact on how both investors and managers assess opportunities. And it’s at the root of what we call the capitalist’s dilemma.

Let’s back up to see where this assumption came from. A fundamental tenet of economics is that some of the inputs required to make a product or service are abundant and cheap—like sand. We don’t need to account for such inputs and can waste them, if need be. Others are scarce and costly and must be husbanded carefully. Historically, capital was scarce and costly. So investors and managers alike were taught to maximize the revenue and profit per dollar of capital deployed.

While it’s still true that scarce resources need to be managed closely, it’s no longer true that capital is scarce. A recent Bain & Company analysis captures this point nicely, concluding that we have entered a new environment of “capital superabundance.” Bain estimates that total financial assets are today almost 10 times the value of the global output of all goods and services, and that the development of financial sectors in emerging economies will cause global capital to grow another 50% by 2020. We are awash in capital.

Because they were taught to believe that the efficiency of capital was a virtue, financiers began measuring profitability not as dollars, yen, or yuan, but as ratios like RONA (return on net assets), ROIC (return on invested capital), and IRR (internal rate of return). These ratios are simply fractions, comprising a numerator and a denominator, but they gave investors and managers twice the number of levers to pull to improve their measured performance. To drive RONA or ROIC up, they could generate more profit to add to the numerator, of course. But if that seemed daunting, they could focus on reducing the denominator—outsourcing more, wiping more assets off the balance sheet. Either way, the ratio would improve. Similarly, they could increase IRR either by generating more profit to grow the numerator or by reducing the denominator—which is essentially the time required to get the return. If they invested only in projects that paid off quickly, then IRR would go up.

Do We Need a Revolution?

THE ORTHODOXIES GOVERNING FINANCE are so entrenched that we almost need a modern-day Martin Luther to articulate the need for change. Here’s what reform might address:

Thesis 1. We need new ways to assess investments in innovation. Our success metrics determine what we can and cannot invest in. We have allowed a minority to dictate those metrics to the majority. Over and over, the higher value placed on return on net assets, internal rate of return, and earnings per share over other metrics has led to innovations that squeeze costs and noncash assets. As a result, investing to create growth and jobs is a third-best option, behind efficiency innovations (first) and doing nothing (second).

Thesis 2. We should no longer husband capital. It is abundant and cheap. We should use it, not hoard it. What managers see inside their company’s resource allocation processes likely does not reflect the new reality in the economy and in the capital markets. Hurdle rates aren’t handed down by a deity; they can (and should) be changed as the cost of capital changes.

Thesis 3. We need new tools for managing the resources that are scarce and costly. How would we measure the success of investments in making good people better, for example, or in our ability to attract and retain talent? What if we prioritized time as a scarce resource?

All of this makes market-creating innovations appear less attractive as investments. Typically, they bear fruit only after five to 10 years; in contrast, efficiency innovations typically pay off within a year or two. What’s worse, growing market-creating innovations to scale uses capital, which must often be put onto the balance sheet. Efficiency innovations take capital off the balance sheet, however. To top it off, efficiency innovations almost always seem to entail less risk than market-creating ones, because a market for them already exists. Any way you look at it, if you measure investments using these ratios, efficiency innovations always appear to be a better deal.

What Has Become of the Long-Term Investor?

One might expect that, even if this approach to measurement appealed to short-term investors, we’d see countervailing pressure from institutional investors, who are ostensibly focused on long-term value creation. Take pension funds, the largest category of investor globally, representing more than $30 trillion in assets, almost $20 trillion of that just in U.S. pension funds. In theory, no investor is better positioned to model “patient capital” behavior. However, for the most part pension funds don’t demonstrate patience: In fact, they have led the pack in the search for high short-term returns. One of the most spirited exchanges among our alumni centered on that apparently self-defeating behavior and what, if anything, might be done about it. It turns out that because of a variety of factors—depressed returns, substantial unfunded commitments, and longer life expectancies—the funds aren’t growing fast enough to meet their obligations. So they look for quick payoffs and demand that the companies they invest in, and the managers they invest with, meet high hurdle rates. A failure to adjust expectations—and hurdle rates—will keep pension funds on the sidelines in coming years, making a bad situation even worse.

Venture capitalists might also be expected to look past ratio-centric metrics, since market creation appears to be their focus. And many VCs do. But many others invest mostly in companies that are developing performance-improving and efficiency innovations and can be sold within a couple of years to a large industry incumbent. Several of our alumni noted this bias in their interactions with VCs, many of whom are drawn to business plans that target well-defined markets, just as corporate executives are.

What about the low cost of capital? Shouldn’t that create incentives for corporate managers—and outside investors—to invest their cash in ambitious market-creating innovations? Technically, it is true that the cost of capital is low—indeed, the Fed’s interest rate for lending to banks is near zero. But neither companies nor investors experience it like that. Entrepreneurs claim in their business plans that investors will make their money back five times over. Venture capitalists ask for even higher returns. Internal corporate business plans routinely promise returns from 20% to 25%—because that is the historical corporate cost of equity capital. Investors and managers were all taught that calculations of the present value of potential investments should be based on that corporate cost, adjusted for differences in risk. From the perspective of the individuals seeking funding, the quoted list price of capital before making the investment is anything but zero.

What individuals don’t observe, however, is that the actual return investors of the capital receive after it has been deployed is, on average, approaching zero. Today every attractive opportunity is being eyed by many more investors—and also being pursued by many more companies—than was the case in the past. All the competition drives the price of the deals so high that the returns to investors are dramatically compromised. For nearly a decade, the actual returns of all VC-backed investments, which were promised to be at least 25%, have totaled up to zero every year. Professor William Sahlman named this paradox “capital market myopia.”

Year after year, public U.S. corporations announce plans to invest in new growth markets. And yet if you dig into their research and development budgets, you’ll find that very little of that money targets market-creating innovations. Some is being spent on performance-improving innovations, but the lion’s share is allocated to efficiency innovations. And more than the executives of these enterprises imagine. One of our alumni noted the recent ascendance of the metric “return on research capital” (RORC). This measure, current year profit over prior year research expenditure, justifies only the most tightly scoped performance-improving or efficiency innovations.

Our alumni expressed deep frustration over the way that the resource allocation process is biased against profitable, high-growth opportunities in new markets and favors predictable investments focused on current customers. This leads to a paradox: Competing for a point of share in an established market appears to be easy, even in the face of fierce competition. Investing to create a new market appears to be hard, even in the absence of headwinds and with the prospect of a much more sizable, and profitable, opportunity. One recent alumnus, a product manager at a highly respected Fortune 100 manufacturer, noted, “We’ve lost the concept of having a portfolio of businesses. Out of every business we expect incremental improvement on these key financial metrics.” He thought this produced a crowded, efficiency-focused, near-term agenda. “If I try to advocate for a different approach, the response will be, ‘Sounds like an interesting idea—let’s talk about it at the end of the fiscal year,’” he told us.

The result of all these interrelated failures is that the institutions meant to lubricate capitalism no longer do so. Banks, in particular, seem beset by boredom, unenthusiastic about actually making commercial loans, as many small and medium-size businesses will attest. This reluctance to lend is likely to erode banks’ franchise permanently, as scores of alternative lending entities are being created to fill the void. The Federal Reserve, whose primary tool for stimulating the economy is increasing the supply of money and keeping interest rates low, doesn’t work because interest is no longer a significant factor in businesses’ cost structure.

This, then, is the capitalist’s dilemma: Doing the right thing for long-term prosperity is the wrong thing for most investors, according to the tools used to guide investments. In our attempts to maximize returns to capital, we reduce returns to capital. Capitalists seem uninterested in capitalism—in supporting the development of market-creating innovations. Left unaddressed, the capitalist’s dilemma might usher in an era of “post-capitalism.” Adam Smith’s “invisible hand” is meant to work behind the scenes, efficiently allocating capital and labor to sectors in which prices and returns are rising, and taking resources away from those in which they’re falling. But if the cost of capital is insignificant, it emits only the faintest of signals to the invisible hand about where and when capital should flow.

Renewing the System

Although the reasons for the collective reluctance to invest in market-creating innovations are straightforward, they defy simple answers. Nonetheless, in the following paragraphs we’ll propose four solutions worth exploring.

Repurposing capital

In contrast to the providers of capital, capital itself is highly malleable, in that certain policies can “convince” capital that it “wants” to do things differently. Today much of capital is what we might call migratory. It lacks a home. When invested, migratory capital wants to exit as quickly as possible and to take out as much additional capital as possible before it does. A second type of capital is timid. It is risk-averse. Much of timid capital resides as cash and equivalents on companies’ balance sheets, where making no investment is better than making an investment that might fail. Another type is enterprise capital. Once injected into a company, enterprise capital likes to stay there. Resolving the capitalist’s dilemma entails “persuading” migratory and timid capital to become enterprise capital.

One way to repurpose capital is through tax policy. Our alumni had a spirited exchange on the wisdom of imposing a Tobin tax on financial transactions to reduce high-frequency trading, which would increase illiquidity and therefore (it is thought) investment in innovation. Such a tax would be anything but simple to devise and enforce, but a growing body of academic and empirical evidence suggests it could be effective at repurposing capital by lengthening shareholder tenure.

A company-level approach would be to reward shareholders for loyalty. Our alumni suggested several ways to accomplish this. One is to align shareholder influence with shareholding period, allowing voting power to vest over time the way employee stock options do. The alumnus who suggested this gave the following rationale: Why should investors who are mere tourists, holding stock for weeks or months, be given the same full voting power as long-term owners? Another method involves extra-share or extra-dividend mechanisms known as L-shares. The most popular L-share scheme in current use is a call warrant that’s exercisable at a fixed time horizon and price if the share is held for the entire loyalty period.

When the World Is Awash in Capital

INTEL IS THE ONLY significant U.S. semiconductor company that still makes its own chips. If you measure profitability using return on assets, the other companies are much more profitable, for a simple reason: Outsourcing fabrication to contractors like Taiwan Semiconductor Manufacturing Company (TSMC) reduces the denominator in that ratio.

In 2009 Clay Christensen interviewed Morris Chang, founder of TSMC, about this phenomenon. Chang had been second-in-command at one of the most powerful semiconductor companies in America, Texas Instruments, before he returned to his native Taiwan and founded TSMC. At the time of this interview, TSMC was making more than half of all semiconductor circuits in the world.

Clay said to Chang, “Every time a new customer outsources to you, he peels assets off of his balance sheet, and in one way or another puts those assets on your balance sheet. You both can’t be making the right decision.”

“Yes, if you measure different things, both can be right,” Chang replied. “The Americans like ratios, like RONA, EVA, ROCE, and so on. Driving assets off the balance sheets drives the ratios up. I keep looking. But so far I have not found a single bank that accepts deposits denominated in ratios. Banks only take currency.

“There is capital everywhere,” Chang continued. “And it is cheap. So why are the Americans so afraid of using capital?”

These and other proposals to create loyalty shares and bonuses, and royalty shares that facilitate investment in targeted, long-term market development projects, are still a novelty and are subject to all manner of gaming, but they are coming up more often in board conversations and in corporate prospectuses.

Rebalancing business schools

Much as it pains us to say it, a lot of the blame for the capitalist’s dilemma rests with our great schools of business, including our own. In mapping the terrain of business and management, we have routinely separated disciplines that can only properly be understood in terms of their interactions with one another, and we’ve advanced success metrics that are at best superficial and at worst harmful.

Finance is taught independently in most business schools. Strategy is taught independently, too—as if strategy could be conceived and implemented without finance. The reality is that finance will eat strategy for breakfast any day—financial logic will overwhelm strategic imperatives—unless we can develop approaches and models that allow each discipline to bring its best attributes to cooperative investment decision making. As long as we continue this siloed approach to the MBA curriculum and experience, our leading business schools run the risk of falling farther and farther behind the needs of sectors our graduates aspire to lead.

The intricate workings of the resource allocation process often are not studied at all in business schools. As a result, MBAs graduate with little sense of how decisions in one part of the enterprise relate to or reflect priorities in other parts. One of our alumni noted, “The only way we learned what projects to invest in was in FIN I [the introductory finance course at HBS].” A whole host of questions goes unasked—and unanswered: How do I identify conditions that signal opportunity for long-term, growth-creating investment? What proxies for estimated future cash flows can I use in evaluating an investment that is pointed toward a new market? How do we identify and build innovations that will help noncustomers perform jobs they need to get done? When are the traditional metrics of IRR and NPV most appropriate, and when are they likely to lead us astray? Since the functions of the enterprise are interdependent, we should mirror this in our teaching.

Realigning strategy and resource allocation

The alumni debated a number of potential solutions to the resource allocation processes’ bias against market-creating opportunities. The solutions all were founded on the insight that setting the risk-adjusted cost of capital in the valuation of opportunities is a choice. If we are realistic about the true cost of capital, investing in the long term becomes easier.

The alumni also expressed broad support for bringing transparency to R&D spending through the creation of an “innovation scorecard” that categorized spending by the taxonomy we’re developing here. The intent was to give leaders an internal tool for analyzing the innovation pipeline and the prospects for growth it contains.

Emancipating management

Many managers yearn to focus on the long term but don’t think it’s an option. Because investors’ median holding period for shares is now about 10 months, executives feel pressure to maximize short-term returns. Many worry that if they don’t meet the numbers, they will be replaced by someone who will. The job of a manager is thus reduced to sourcing, assembling, and shipping the numbers that deliver short-term gains.

While it’s true that most companies, private and public, have shareholders who invest with an eye to the short term, they also have those who are focused on the long term—citizens, not tourists, to use the metaphor introduced earlier. The expectations of the two types of investors have diverged. Efforts to satisfy one group will conflict with the demands of the other. Because no policy can maximize returns for all shareholders, the only viable approach is to manage the company to maximize the value of the enterprise in the long run. It’s the job of managers and academics alike to develop the tools to support this endeavor. They can make a good start by treating spreadsheets as a useful tool that complements strategic decision making but is not a substitute for it. (See “Spreadsheets: The Fast Food of Strategic Decision Making.”)

The problem, of course, is not with our tools but with ourselves. As one alumnus noted in a very funny post, our ratios and tools tell us exactly what they claim to tell us: Return on assets is … the return on assets; DCF is … the discounted cash flows. The problem is in how the ratios are understood and applied. We have regressed from the decades when Drucker and Levitt urged us not to define the boundaries of our businesses by products or SIC codes but to remember that the point of a business is to create a customer.

Spreadsheets: The Fast Food of Strategic Decision Making

JUST AS abundant, cheap fast food helped create an epidemic in obesity and diabetes, the popularity of spreadsheets has given rise to an unhealthy dependence on metrics like return on invested capital and internal rate of return.

Before 1978, when the spreadsheet was invented by a student at Harvard Business School, such metrics existed, but calculating them was cumbersome, since pro forma financials were done by hand with simple four-function calculators. These metrics were judiciously used as inputs, but investment decisions were rarely based on them.

The spreadsheet made it simple for analysts to build financial models of companies, allowing them to study how different inputs and assumptions affected the metrics of value. Armed with this tool, a 26-year-old Wall Street analyst could then sit across the desk from a CEO and tell her how to run her company. Not only that, the analyst could explain that “the market” would punish the CEO if she did not follow the orthodoxies of new finance, too. The rules of this game, by the way, were devised by the analysts themselves, tilting the playing field against the CEO and in favor of the analysts’ spreadsheets—which were preprogrammed to predict when the CEO wouldn’t meet an anticipated number and to set up a short sale or custom-made derivative.

Scott Cook, the founder and executive chairman of Intuit (an HBS alumnus who knows our course well), shared his views on what he sees as the tyranny of financial metrics. He has observed that a focus on financial outcomes too early in the innovation process produces “a withering of ambition.” He argues that financial metrics lack predictive power. “Every one of our tragic and costly new business failures had a succession of great-looking financial spreadsheets,” he says. Now new-product teams at Intuit do not submit a financial spreadsheet to begin work and testing; rather, he notes, they focus on “where we can change lives most profoundly.”

In a very real sense, too many executives have outsourced the job of managerial judgment and decision making to this convenient—but ultimately unnutritious—tool. One simple way to put it in its proper place is to resolve never to begin or end an investment conversation with reference to a spreadsheet.

Dilemmas and paradoxes stymie capable people when they don’t understand what surrounds them and why. That’s the reason the innovator’s dilemma historically has paralyzed so many smart managers. Managers who take the time to understand the innovator’s dilemma, however, have been able to respond effectively when faced with disruption. Now it appears that we face a capitalist’s dilemma. We hope that this attempt to frame the problem will inspire many of you to work with us to devise solutions to this dilemma, not just for the individual good that might result but for the long-term prosperity of us all.

Originally published in June 2014. Reprint R1406C