Paying for College Without Going Broke, 2017 Edition - Princeton Review, Kalman Chany (2016)

Part IV. The Offer & Other Financial Matters

On the day that the offers from colleges arrive there will be many dilemmas for parents. One of the most vexing is deciding whether to steam open the letters from the colleges, or wait until the student gets home from school. We can set your mind at ease about this dilemma at least. You can usually tell an acceptance letter from a rejection letter even without opening it—acceptance letters weigh more. This is because as long as you met your deadlines, you should receive financial aid packages in the same envelopes the acceptance letters came in. Most colleges will need a commitment from you before May 1. This gives you only a few weeks to sift through the offers, compare them, and—if possible—negotiate with the FAOs to improve them.

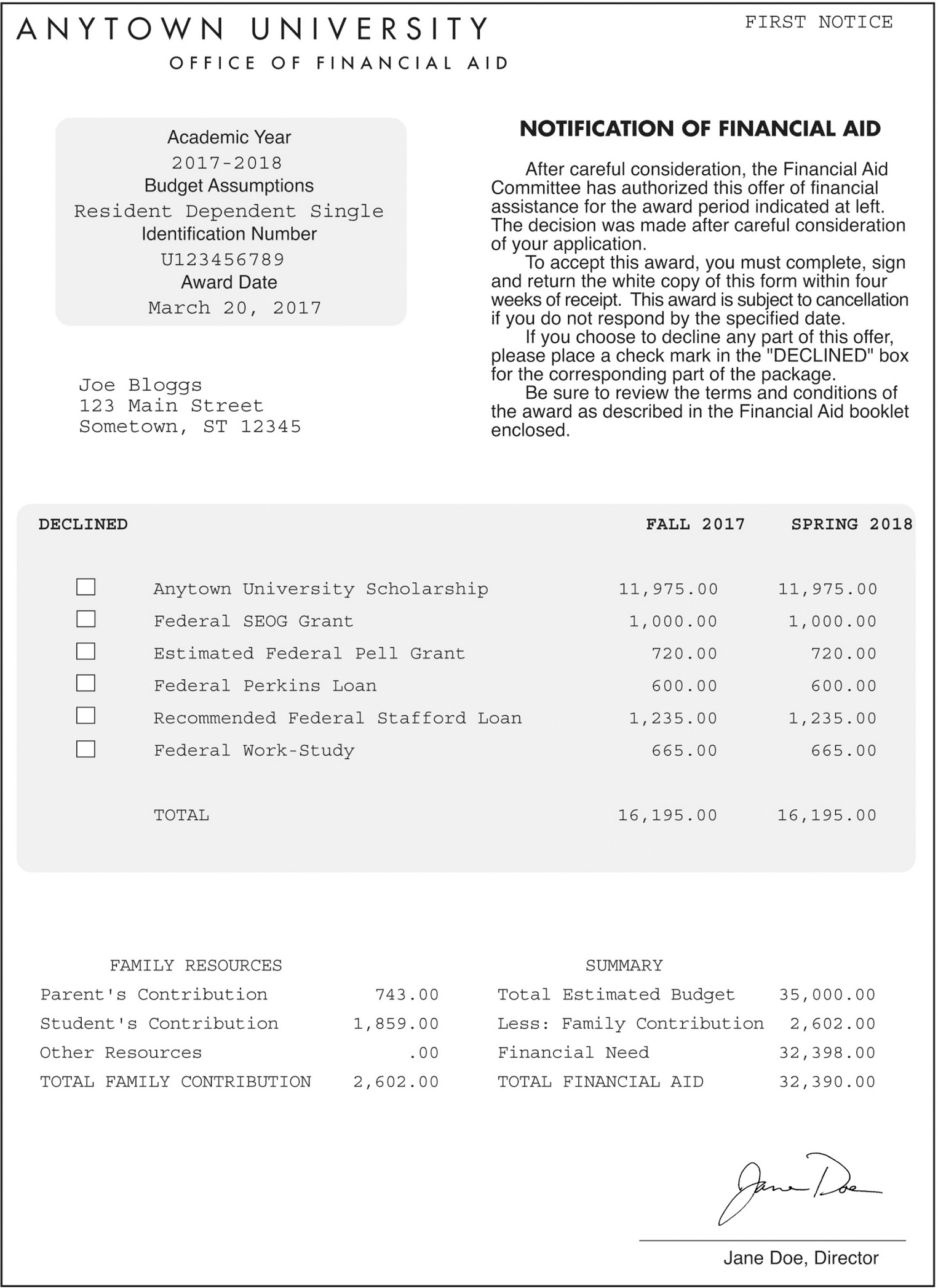

The details of an aid package will be spelled out in the award letter. This letter will tell you the total cost of one year’s attendance at the college, what the college decided you could afford to pay toward that cost, and what combination of grants, loans, and work-study the college has provided to meet your “need.”

On the following page you will find a sample award letter from Anytown University located in Anytown, State.

Click here to download a PDF of a sample offer letter.

Note that in this case, the family contribution was set at $2,602. The total cost of attendance at Anytown for that year was $35,000. Thus, this family had a remaining “need” of roughly $32,390 which was—in this case—met in full with a mixture of grants, loans, and work-study.

The Bloggs were evidently a high-need family, and received an excellent package: $27,390 in grants (outright gift aid, which did not need to be repaid), $1,330 in work-study, and $3,670 in loans for the year.

Not all colleges will meet the entire remaining “need” of every student, and there may have been a number of reasons why the package was so good in the case of the sample student in the report above. Perhaps Joe Bloggs was a particularly bright student or the impoverished grandchild of a distinguished alumnus.

The Different Types of Financial Aid in Detail

Let’s examine the different types of financial aid that you may be offered in the award letter. An acceptance of the aid package does not commit you to attending the college, so be sure to respond by the reply date (certified mail, return receipt requested, as always). You are allowed to accept or reject any part of the package, but there are some types of aid that should never be rejected.

Grants and Scholarships: These should never be rejected. This money is almost always tax-free and never has to be repaid. Grants and scholarships come in different forms.

The Federal Pell Grant: This grant is administered by the federal government, and like all federal aid, is awarded only to U.S. citizens or eligible noncitizens. The Pell is primarily for low-income families. You automatically apply for the Pell Grant when you fill out the FAFSA. The size of the award is decided by the federal government and cannot be adjusted by the colleges. If you qualify, you will receive up to $5,815 per year, based on need.

The Federal Supplemental Educational Opportunity Grant or SEOG: This is a federal grant that is administered by the colleges themselves. Each year, the schools get a lump sum that they are allowed to dispense to students at their own discretion. The size of the award runs from $100 to $4,000 per year per student.

Grants from the Schools Themselves: The colleges themselves often award grants as well. Since this money comes out of their own pocketbook, these grants are in effect discounts off the sticker price. And because this is not taxpayer money, there are no rules about how it must be dispensed. Some schools say they award money solely based on need. Many schools also give out merit-based awards. There is no limit on the size of a grant from an individual school. It could range from a few dollars to a full scholarship. Obviously, richer schools have more money to award to their students than poorer schools.

State Grants: If a student is attending college in his state of legal residence, or in a state that has a reciprocal agreement with his state of legal residence, then he may qualify for a state grant as well. These grants are administered by the states themselves. The grants are based on need, as well as on the size of tuition at a particular school. Thus the same student might find that his state grant at the local state university would be smaller than his state grant at a private college. These grants vary from state to state but can go as high as $6,000 per year or more.

Scholarships from the School: Some schools use the words grants and scholarships more or less interchangeably, and award scholarships just like grants—in other words, based on need. Other schools give scholarships in their more traditional sense, based on merit, either academic, athletic, or artistic. Some schools give scholarships based on a combination of need and merit.

The only real difference as far as you are concerned is whether the scholarship is used to meet need or whether it may be used to reduce your family contribution. If the school wants you badly enough, you may receive a merit-based scholarship over and above the amount of your need.

The Teacher Education Assistance for College and Higher Education (TEACH) Grant Program: This federal grant program provides grants of up to $4,000 per year to students who intend to teach full-time in a high need field in a private elementary or secondary school that serves students from low-income families. To qualify, you must attend a school that has chosen to participate in the program and meet certain academic achievement requirements along with other requirements. It is important to note that failing to complete all of the service requirements (e.g.. teaching four years within eight years of completing the program of study for which you received the grant at designated schools) will result in the amount of all TEACH grant funds received being converted to a Federal Direct Unsubsidized Stafford Loan (see this page-this page)

Outside Scholarships: If you have sought out and won a scholarship from a source not affiliated with the college—a foundation, say, or a community organization—you are required to tell the colleges about this money. Often the scholarship donor will notify the colleges you applied to directly. In most cases, the schools will thank you politely and then use the outside scholarship to reduce the amount of grant money they were going to give you. In other words, winning a scholarship does not mean you will pay less money for college; your family contribution often stays exactly the same.

By notifying the colleges about an outside scholarship before getting your award letter, you ensure that the outside scholarship will be included as part of your package. This is not very satisfactory because you have effectively given away an important bargaining chip.

If you have managed to find and win one of these scholarships, you may feel that you deserve something more than thanks from the school for your initiative. By telling the FAO about an outside scholarship for the first time when you are negotiating an improved package, you may be able to use the scholarship as a bargaining chip. Some schools have specific policies on this; others are prepared to be flexible. In some cases, we have seen FAOs let the parents use part of that money to reduce the family contribution. In other cases, FAOs have agreed to use the scholarship to replace loan or work-study components of the package instead of grants from the school.

Federal Work-Study: Under this program, students are given part-time jobs (usually on campus) to help meet the family’s remaining need. Many parents’ first inclination is to tell the student to reject the work-study portion of the aid package. They are concerned that the student won’t have time to do well in class. As we’ve said earlier, several studies suggest that students who work during college have as high or higher grade point averages as students who don’t work.

We counsel that you at least wait to see what sort of work is being offered. The award letter will probably not specify what kind of work the student will have to do for this money. You will get another letter later in the year giving you details. In many cases these jobs consist of sitting behind a desk at the library doing homework. Since students can normally back out of work-study jobs at any time, why not wait to see how onerous the job really is? (A minuscule number of colleges do have penalties for students who fail to meet their work-study obligations, so be sure to read the work-study agreement carefully.)

While work-study wages are usually minimum wage or slightly higher, they carry the important added benefit of being exempt from the aid formulas; work-study wages do not count as part of the student’s income. Other earnings, by contrast, may be assessed at a rate of up to 50 cents on the dollar. In addition, each dollar your child earns is a dollar you won’t have to borrow.

Some colleges give you the choice of having the earnings paid in cash or credited toward the next semester’s bill. If your child is a spendthrift, you might consider the second option.

Loans: There are many different kinds of college loans, but they fall into two main categories: need-based loans, which are designed to help meet part of a family’s remaining need; and non-need-based loans, which are designed to help pay part of the family contribution when the family doesn’t have the cash on hand. The loans that will be offered as part of your aid package in the award letter are primarily need-based loans.

The best need-based loans (the federally subsidized Perkins and Stafford loans) are such good deals that we feel families should always accept them if they are offered. (Both are far below prevailing interest rates.) In most cases, no interest is charged while the student is in school, and repayment does not begin on Perkins or Stafford loans until the student graduates, leaves college, or dips below half-time status. Even if you have the money in the bank, we would still counsel your taking the loans. Let your money earn interest in the bank. When the loans come due, you can pay them off immediately, in full if you like, without penalty. Most college loans with the exception of the Perkins loans have some kind of an origination fee and perhaps an insurance fee as well. These fees are deducted from the value of the loan itself; you will never have to pay them out of your pocket.

Here are the different types of loans in order of attractiveness.

Federal Perkins Loans: Formerly known as National Direct Student Loans (NDSL), these are the best of the federally subsidized loans. The current fixed interest rate is 5%. The loans are made only to the student, with no need for the parent to cosign. Payment begins only after the student graduates, leaves college, or drops below half-time status. No interest accrues during the college years, and students have up to ten years to repay. Although the money comes from the government, these loans are administered through the college aid office.

The federal government gives the college a lump sum each year, but the FAO gets to decide which students receive these loans and how much they receive, based on need. Undergraduates can borrow up to $5,500 per year, with a cap of $27,500. The amount of money each school has available to lend out each year depends to some extent on the vicissitudes of Congress, but also on the default rate of the school’s former students. If the school’s students have a low default rate on paying back these loans, there will be more money available to recycle to new student borrowers. The government also tends to reward these schools with larger infusions of new loan capital.

This program faces elimination and only prior borrowers may receive additional money in future years.

Federal Stafford Loans: There are two kinds of Stafford loans. The better kind is the subsidized Stafford loan. To get this, a student must be judged to have need by the college. The federal government then subsidizes the loan by not charging any interest until after the student graduates, leaves college, or goes below half-time attendance status.

The second kind of Stafford loan is known as unsubsidized and is not based on need. From the moment a student takes out an unsubsidized Stafford loan, he or she will be charged interest. Students are given the option of paying the interest while in school, or deferring the interest payments (which will continue to accrue) until repayment of principle begins. Virtually all students who fill out a FAFSA are eligible for these unsubsidized Stafford loans.

In both cases, the federal government guarantees the loan, and if applicable, makes up any difference between the student’s low interest rate and the prevailing market rate once repayment has begun. A dependent student may be eligible to borrow up to $5,500 for the freshman year, up to $6,500 for the sophomore year, and up to $7,500 per year for the remaining undergraduate years. However for all of these annual limits, at least $2,000 must be unsubsidized in any year.

An independent undergraduate can borrow up to $9,500 for the freshman year (of which at least $6,000 must be unsubsidized), up to $10,500 for the sophomore year (of which at least $6,000 must be unsubsidized), and up to $12,500 per year for the remaining undergraduate years (of which at least $7,000 per year must be unsubsidized).

Beginning with the 2012-2013 academic year, all Stafford Loans for graduate/professional school students are now unsubsidized with a maximum annual borrowing limit of $20,500 (which is even higher for certain health profession students.) Any student contemplating graduate school/professional school in future years should be sure to refer to Chapter Eight (Managing Your Debt) that begins on this page.

What happens if an undergraduate student is awarded a subsidized Stafford loan, but the amount is less than the maximum subsidized amount? In this case, the student can borrow up to the amount of her need as a subsidized Stafford loan and, if she wants, she can also take out an unsubsidized Stafford loan for the remainder of the total annual borrowing limit.

Based on a recent deal in Congress, the interest rate for new Stafford Loans originated on or after July 1, 2013 will now be pegged to the 10-year Treasury Note rate with the rate fixed for the life of the loan. Compared to recent years, there will now be different rates for undergraduate student and graduate/profession school students. However, unlike the past few years, the fixed rate will be the same whether the loan is subsidized (available only to undergrads) or unsubsidized. For loans originated during the 2016-2017 academic year, this will mean the rate for these new Stafford loans originated during the 2016-2017 academic year will be fixed at 3.76% for undergraduates and 5.31% for graduate/professional school students. This means the Stafford Loan interest rate for undergrads for loans originated during the 2016-2016 academic year will be less than the interest rate charged on a Perkins Loan—but the reverse will be true for graduate/professional school students at least during 2016-2017.

The rates for new Stafford loan originated during subsequent academic years will be based on the last 10-year Treasury Note auction in May prior to the start of that subsequent academic year. However, there are interest rate caps for Stafford loans (that would only apply to newly-originated loans taken out in subsequent academic years) should the 10-year Treasury Note rate rise significantly. For undergraduates the cap will be 8.25%—with a 9.5% cap on Staffords for graduate/professional school students.

Because the government guarantees the loans, parents are never required to cosign a Stafford (or Perkins) loan.

Starting in the 1994-95 academic year, under a law proposed by President Clinton, some of the Stafford loans were funded directly by the government and administered by the schools—thus eliminating the role of private lenders such as banks. This program, referred to as the William D. Ford Federal Direct Loan Program, co-existed with the Federal Family Education Loan Program (FFELP) for a number of years. The schools would decide which program they would have Stafford borrowers use to get their loan proceeds and the majority of such loans (in terms of loan volume) were originated with FFELP private lenders as the middleman. However as part of the Health Care and Education Reconciliation Act of 2010, all new Stafford loans disbursed after June 30, 2010 will be via the Direct Loan program.

Once you have decided on a college and accepted the aid package, the FAO will tell you how to go about obtaining the loan funds. You will have to fill out a promissory note, and because the process can take as long as six weeks, it may be necessary to apply for the loan by mid-June for the fall term.

The College’s Own Loans: These loans vary widely in attractiveness. Some are absolutely wonderful: Princeton University offers special loans for parents at very low rates. Some are on the edge of sleazy: Numerous colleges have loan programs that require almost immediate repayment with interest rates that rival VISA and MasterCard. While these types of loans do not normally appear as part of an aid package, a few colleges try to pass them off as need-based aid to unsuspecting students and their parents. Remember that you are allowed to reject any portion of the aid package. It is a good idea to examine the terms of loans from the individual colleges extremely carefully before you accept them.

Financial Sleight of Hand

As we’ve already said, there are two general types of college loans: the need-based loans (such as the Perkins and the subsidized Stafford loans we’ve just been discussing), are meant to meet a family’s “remaining need”; the other kind of loan is meant to help when families don’t have the cash to pay the family contribution itself.

By its very nature this second type of loan should not appear as part of your aid package. As far as the colleges are concerned, your family contribution is your business, and they don’t have to help you to pay it. However, a number of schools do rather unfairly include several types of non-need-based loan in their aid package, including the unsubsidized Stafford loan we just discussed, and the PLUS (Parent Loans for Undergraduate Students) which is intended to help those parents who are having trouble paying their family contribution. Subsidized by the government, the PLUS loan is made to parents of college children. Virtually any parent can get a PLUS loan of up to the total cost of attendance minus any financial aid received—provided the federal government thinks the parent is a good credit risk.

Thus when a college tries to meet your need with a PLUS loan, the college is engaging in financial aid sleight of hand, ostensibly meeting your need with a loan that was not designed for that purpose and which you could have gotten anyway, as long as your credit held up. If you are offered a PLUS loan as part of your need-based aid, you should realize that the college has really not met your need in full. An aid package that includes a PLUS loan is not as valuable as a package that truly meets a family’s remaining need.

With the PLUS loans, repayment normally begins within 60 days of the date the loan was made. However, legislation now permits a PLUS loan borrower to delay repayment on a PLUS loan taken out for a student until that student graduates, leaves school, or drops below half-time status. You will need to notify the lender if you wish to defer repayment in such cases.

Non-Need-Based Loans

While the other types of college loans won’t be part of your aid package, this seems like a good place to describe a few of them, and they are certainly relevant to this discussion, for as you look at the various offers from the colleges you will probably be wondering how you are going to pay your family contribution over the next four years. Most families end up borrowing. There are so many different loans offered by banks and organizations that it would be impossible to describe them all. College bulletins usually include information about the types of loans available at the specific schools, and applications can usually be picked up at the colleges’ financial aid offices or be filed online. Here’s a sampling of some of the more mainstream alternatives (we’ll talk about a few of the more offbeat loans in the next chapter):

PLUS Loans: We’ve already discussed some details of PLUS loans above. As credit-based loans go, the PLUS is probably the best. Parents can borrow up to the annual total cost of attendance at the college minus any financial aid received. With all PLUS loans now disbursed via the Direct Loan Program, you will apply for the PLUS loan through the financial aid office.

The recent student loan deal has also changed the way the fixed rate on any new PLUS loans will be calculated, with the new rate also based on the 10-year Treasury Note rate instead of a legislated rate. For PLUS loans originated during the 2015-2016 academic year, the interest rate will be 6.31% —which is less than the 7.9% rate that had been charged on fixed rate Direct PLUS loans originated prior to July 1, 2013. For loans originated for the 2013-2014 academic year and beyond, there is a cap of 10.5% (that would only apply to newly-originated PLUS loans taken out in subsequent academic years should the 10-year Treasury Note rate rise significantly).

When we suggest the PLUS loans to some of our clients, their immediate response is, “There’s no way we’ll qualify; we don’t have a good credit rating!” Before you automatically assume you won’t qualify, you should realize that the credit test for the PLUS is not as stringent as it is for most other loans. You don’t have to have excellent credit to qualify. You just can’t have an “adverse credit history” (i.e. outstanding judgments, liens, extremely slow payments). Even if you fail the credit test, you may still be able to secure a PLUS loan provided you are able to demonstrate extenuating circumstances (determined on a case-by-case basis by the lender) or you are able to find someone (a friend or relative) who can pass the credit test, who agrees to endorse (i.e. cosign) the loan, and who promises to pay it back if you are unable to do so.

In 2014, the Department of Education relaxed the credit requirements necessary to receive the loan.

If you are rejected for the PLUS loan and are unable to get a creditworthy endorser, there is still another option available to you. In this case, dependent students can borrow extra Stafford loan funds over the normal borrowing limits. First- and second-year students can get an additional $4,000 per year, while those in the third year and beyond can get an additional $5,000 per year. In all cases, these additional Stafford loan funds must be unsubsidized. Obviously, this approach is going to put the student deeper in debt. However, if you need to borrow a few thousand dollars to cover the family contribution and are unable to get credit in your name, this strategy may be your only option.

State Loans: Some states offer alternative loan programs as well. The terms vary from state to state; some are available only to students, others only to parents; many are below market rate. Unlike state grants, state loans are often available to nonresidents attending approved colleges in that state.

Lines of Credit: Some banks offer revolving credit loans that do not start accruing interest until you write a check on the line of credit.

CitiAssist Loans [www.studentloan.com or (800) 788-3368]: Sponsored by Citibank, these loans to students do not have any origination fees. To make up for this, the interest rate is usually prime plus 0.50% (however this may be lower or higher at some schools). There is no minimum loan amount required. This is one of the few loan programs available to foreign students who can borrow funds by having a credit-worthy cosigner (who must be a U.S. citizen or permanent resident). Cosigners will also be required for almost all undergraduates as well as those students who do not have a positive credit history. Under certain circumstances, the cosigner can be released from the loan after 48 on-time payments are made.

Sallie Mae Smart Option Student Loans [www.salliemae.com or (800) 695-3317]: These cosigned private student loans require payment of interest while the student is in school and during the 6-month separation period before repayment. Cosigners may not be required after freshman year. The interest rate is pegged to the prime rate and will vary depending on the credit rating of the student (and, if applicable, the cosigner) as well as the school attended. This program offers a 0.25% interest rate reduction for students who elect to have their payments made automatically through their bank and a 0.25% interest rate reduction for students who receive all servicing communications via a valid e-mail address.

Collegiate Loans [www.wellsfargo.com or (800) 378-5526]: Wells Fargo Bank operates this non-need-based program for college which offers variable interest loans currently based on the prime rate and your credit history. The student is the borrower, but a parent and/or another individual usually must cosign. One can normally borrow up to the cost of education minus any financial aid.

This is only a partial listing of the different loans available. When choosing which type of loan to take out, you should consider all of the following questions:

✵ What is the interest rate and how is it deternined?

✵ Is the interest rate fixed or variable, and if variable, is there a cap?

✵ What are the repayment options? How many years will it take to pay off the loan? Can you make interest-only payments while the child is in school? Can you repay the loan early?

✵ Who is the borrower—the parent or the student?

✵ Are there origination fees?

✵ Is a cosigner permitted or required?

✵ Will having a cosigner affect the interest rate and/or origination fees?

✵ Is the loan secured or unsecured? The rates on a loan secured by the home or by securities are generally lower, but you are putting your assets on the line.

✵ Is the interest on the loan tax-deductible?

On balance, the PLUS loan is probably the best of all these options. Unless you are able to secure more favorable terms from a state financing authority’s alternative education loan program, then the only reasons to consider the other types of non-need-based loans, besides the PLUS loan, are if you prefer having the loans in the student’s name or if the student is an independent student.

Should You Turn Down Individual Parts of an Aid Package?

Some parents worry that by turning down part of the financial aid package they are endangering future aid. Clearly, by refusing a work-study job or a need-based loan, you are telling the FAOs that you can find the money elsewhere, and this could have an impact on the package you are offered next year. In our experience we can’t remember many times when we thought it was a good idea for a family to turn down grants, scholarships, need-based loans, or work-study.

Certainly Not Before You Compare All the Packages

Before you turn down any part of a single financial aid package, you should compare the packages as a group to determine your options.

The Size of the Package Is Not Important

Families often get swept up by the total value of the aid packages. We’ve heard parents say, “This school gave us $12,000 in aid, which is much better than the school that gave us only $7,000.” The real measure of an aid package is how much YOU will have to end up paying, and how much debt the student will have to take on. Let’s look at three examples:

School A:

total cost—$30,000

family contribution—$11,000

grants and scholarships—$14,000

need-based loans—$3,000

work-study—$1,000

unmet need (what the parents will have to pay in addition to the family contribution)—$1,000

value of the aid package—$18,000

money the family will have to spend—$12,000

need-based debt—$3,000

School B:

total cost—$29,000

family contribution—$11,000

grants and scholarships—$17,000

need-based loans—$500

work-study—$500

unmet need—$0

value of the aid package—$18,000

money the family will have to spend—$11,000

need-based debt—$500

School C:

total cost—$25,000

family contribution—$10,500

grants and scholarships—$10,750

need-based loans—$3,250

work-study—$500

unmet need—$0

value of the aid package—$14,500

money the family will have to spend—$10,500

need-based debt—$3,250

School A and school B gave identical total dollar amounts in aid, but the two packages were very different. School B gave $17,000 in grants (which do not have to be repaid), while A gave only $14,000. School B would actually cost this family $11,000 with only $500 in student loans. School A would cost the family $12,000 with $3,000 in student loans. Leaving aside for the moment subjective matters such as the academic caliber of the two schools, school B was a better buy.

School C would cost this family $10,500 in cash. On the other hand, this school also asked the student to take on the largest amount of debt: $3,250.

You’ve probably noticed that the sticker prices of the three colleges were almost totally irrelevant to our discussion. After you’ve looked at the bottom line for each of the colleges that have accepted the student, you should also factor in the academic quality of the schools; perhaps it is worth a slightly higher price to send your child to a more prestigious school. You should also look at factors like location, reputation of the department your child is interested in, and the student’s own idea of which school would make her happiest. In the end, you’ll have to choose what price you’re willing to pay for what level of quality.

Is the Package Renewable?

An excellent question, but unfortunately this is a very difficult question to get a straight answer about. Of course there are some conditions attached to continuing to receive a good financial aid package. Students must maintain a minimum grade point average, and generally behave themselves.

It also makes sense to avoid colleges that are on the brink of bankruptcy, since poor schools may not be able to continue subsidizing students at the same level.

Bait and Switch?

Most reputable colleges don’t indulge in bait-and-switch tactics, whereby students are lured to the school with a sensational financial aid package that promptly disappears the next year.

We have found that when parents feel they have been victims of bait and switch, there has often been a misunderstanding of some kind. This might occur when parents have two children in school at the same time. If one of the children graduates, the parents are often surprised when the EFC for the child who remains in college goes up dramatically. This is not bait and switch. The family now has more available income and assets to pay for the child who is now in college alone.

Sometimes, schools minimize work-study hours during the first year so that students have a chance to get accustomed to college life. Parents are often shocked when the number of work-study hours is increased the next year, but again this is not bait and switch. It is reasonable to expect students to work more hours in their junior and senior years.

Negotiating with the FAOs

Once you’ve compared financial aid packages and the relative merits of the schools that have said yes, you may want to go back to one or more of the colleges to try to improve your package.

We are not saying that every family should try to better their deal. If you can comfortably afford the amount the college says you must pay, then there is little chance that the college is going to sweeten the deal—it must be pretty good already. College FAOs know just how fair the package they have put together for you is. If you are being greedy, you will not get much sympathy. It is also a good idea to remember that the average FAO is not making a great deal of money. Parents who whine about how tough it is to survive on $200,000 a year will get even less sympathy.

However, if you are facing the real prospect of not being able to send your child to the school she really wants to attend because of money, or if two similarly ranked colleges have offered radically different packages and your son really wants to go to the school with the low package, then you should sit down and map out your strategy.

Negotiate While You Still Have Leverage

After you’ve accepted the college’s offer of admission, the college won’t have much incentive to sweeten your deal, so you should plan to speak to the FAO while it is clear that you could still choose to go to another school. Similarly, you will not have much leverage if you show the FAO a rival offer from a much inferior college.

Try to make an objective assessment of how badly the college wants you. Believe us, the FAOs know exactly where each student fits into their scheme of things. We know of one college that keeps an actual list of prospective students in order of their desirability, which they refer to when parents call to negotiate. If a student just barely squeaked into the school, the family will not be likely to improve the package by negotiating. If a student is a shining star in one area or another, the FAOs will be much more willing to talk.

In the past few years, colleges—especially the selective ones—have become more flexible about their initial offer. Now that FAOs from the different colleges are limited in their ability to sit down together to compare offers to students, the “fudge factor” by which they are willing to improve an offer has increased. We heard one FAO urge a group of students to get in touch with her if they were considering another school. “Perhaps we overlooked something in your circumstances,” she said. What she meant of course was, “Perhaps we want you so much we will be willing to increase our offer.” This FAO represented one of the most selective schools in the country.

Prepare Your Ammunition

Before you call, you should have gathered all the supporting ammunition you can in front of you. If you’ve received a better offer from a comparable school, have it in front of you when you call and be prepared to send a copy of the rival award letter to the school you are negotiating with. (They will probably ask to see it, which brings up another point: don’t lie!)

If you feel that the school has not understood your financial circumstances, be ready to explain clearly what those special circumstances are (such as high margin debts or any other expenses that are not taken into account by the aid formula, support of an elderly relative, or unusually high unreimbursed business expenses). Any documentation you can supply will bolster your claim.

If your circumstances have changed since you filled out your need analysis form (for example, you have recently separated, divorced, been widowed, or lost your job), you should be frank and let the FAOs know. They will almost certainly make changes in your aid package.

The Call

Unless you live within driving distance of the school, your best negotiating tool is the telephone. The FAOs will find it hard to believe that you need more money if you can afford to fly to their college just to complain to them.

If possible, try to speak with the head FAO or one of the head FAO’s assistants. Make sure you write down the name of whoever speaks to you. It is unlikely that he will make a concession on the telephone, so don’t be disappointed if he says he will have to get back to you or if he asks you to send him something in writing.

Some telephone tips:

✵ Be cordial and frank. Like everyone, FAOs do not want to be yelled at and are much more likely to help you if you are friendly, businesslike, and organized.

✵ Have a number in your head. What would you like to get out of this conversation? If the FAO asks you, “All right, how much can you afford?” you do not want to hem and haw.

✵ Be reasonable. If the family contribution you propose has no relation to your EFC, you will lose most of your credibility with the FAO.

✵ Avoid confrontational language. Rather than start off with, “Match my other offer or else,” just ask if there is anything they can do to improve the package. Also avoid using words such as “negotiate” or “bargain”. You’re better off saying you wish to “appeal” the award and then present your facts. Any new information not previously presented could bolster your case, especially if you can provide supporting documentation.

✵ If you are near a deadline, ask for an extension and be doubly sure you know the name of the person you are speaking to. Follow up the phone call with a letter (certified mail, return receipt requested) reminding the FAO of what was discussed in the conversation.

✵ Parents, not students, should negotiate with the FAOs. Some colleges actually have a question on their own financial aid forms in which the parents are asked if they will allow the colleges to speak to the student rather than the parents. Colleges prefer to speak to students because they are easier to browbeat.

✵ Read through this book again before you speak to the FAO. You’ll never know as much about financial aid as she does, but at least you’ll stand a good chance of knowing if she says something that isn’t true.

✵ If you applied “early decision” to a college and that college accepts you, you are committed to attend, and you won’t have much bargaining power to improve your aid package. If you applied and are accepted “early action,” you are not required to attend that school, and it is in your interest to apply to several other schools in order to improve your bargaining position. We discuss both of these options in more detail in the “Special Topics” chapter.

The Worst They Can Say Is No

You risk nothing by trying to negotiate a better package. No matter how objectionable you are, the school cannot take back their offer of admission, and the FAOs cannot take back their aid package unless you have lied about your financial details.

Accepting an Award

Accepting an award does not commit a student to attending that school. It merely locks in the award package in the event the student decides to attend that school. If you haven’t decided between two schools, accept both packages. This will keep your options open for a little longer. Be careful not to miss the deadline to respond. Send your acceptance certified mail, return receipt requested, as always. Above all, don’t reject any award until you have definitely decided which school the student is going to attend. If a school’s aid package has not arrived yet, call the college to find out why it’s late.

If you have been awarded state aid as part of the aid package at the school of your choice, but the award notice you received from the state agency lists the wrong college, you will have to file a form with the state agency to have the funds applied to the school you chose.

Now That You Have Chosen a School

By the time you have chosen a college, you will already be halfway through the second base income year. Now that you understand the ins and outs of financial aid, you will be able to plan ahead to minimize the apparent size of your income and assets, and be in an even better position to fill out next year’s need analysis forms. The first application for financial aid is the hardest, in part because you’re dealing with a number of different schools, in part because it is a new experience. From now on, that first application will serve as a kind of template.

Chapter 7. Innovative Payment Options

Innovative Options

We’ve already discussed the mainstream borrowing options and methods for paying for college. Over the years, colleges, private companies, public organizations, and smart individuals have come up with some alternative ways to pay for college. These ideas range from the commonsense to the high-tech, from good deals for the family to self-serving moneymakers for the colleges and institutions that came up with them. Here is a sampling.

Transfer in Later

Every year a few parents make an unfortunate decision: they send the student off to a college that didn’t give them enough aid. After two years of tuition bills, they’ve spent their life savings, and the banks won’t lend them any more money. The student is forced to transfer to a public university. The result? A diploma from the student’s own State U. that could end up costing the family more than $175,000. The parents paid private school prices for a state school diploma.

What if they had done it the other way around? The student starts out at a state school, paying low prices. She does extremely well, compiling an outstanding academic record and soliciting recommendations from her professors. In junior year she transfers to a prestigious private college. Even if the cost were exactly the same as in the previous example, she now has a diploma from the prestigious private school, at a savings of as much as $75,000 over the regular price.

This scenario won’t work without the part about the “outstanding academic record.” Prestigious private colleges will almost certainly not be interested in a transfer student with a B average or less. The other thing to bear in mind is that aid packages to transfer students are generally not as generous as those given to incoming freshmen.

Both of these points must be factored into a decision to start with a public college and transfer into a select private college. However, if a student really wants a diploma from that selective private college, and the family can’t afford to send her for all four years, then this is a way for her to realize her dream. Anyone interested in this tactic should be sure to consult the individual schools to see how many transfer students are accepted per year, what kind of financial aid is available to them, and how many of the credits earned at the old college will be accepted by the new college.

Cooperative Education

Over 900 colleges let students combine a college education with a job in their field. Generally, the students spend alternate terms attending classes full-time and then working full-time at off-campus jobs with private companies or the federal government, although some students work and study at the same time. The students earn money for tuition while getting practical on-the-job experience in their areas of interest. This program differs from the Federal Work-Study Program in which the subsidized campus-based jobs are probably not within the student’s area of interest, and take up only a small number of hours per week. After graduating, a high percentage of cooperative education students get hired permanently by the employers they worked for during school. Companies from every conceivable field participate in this program. The federal government is the largest employer of cooperative education students.

Getting a degree through the cooperative education program generally takes about five years, but the students who emerge from this program have a huge head start over their classmates; they already have valuable experience and a prospective employer in their field. They owe less money in student loans, and they are often paid more than a new hiree.

If you are eligible for financial aid, you should contact the financial aid office at any college you are considering to determine the effect of cooperative earnings on your financial aid package.

Short-Term Prepayment

Recently, some colleges have been touting tuition prepayment as the answer to all the ills of higher education. In the short-term version of tuition prepayment, the parent pays the college the entire four years’ worth of tuition (room and board are generally excluded) sometime shortly before the student begins freshman year. The college “locks in” the tuition rate for the entire four years. Regardless of how much tuition rises during the four years, the parent will not owe any more toward tuition.

Since most parents don’t have four years of tuition in one lump sum, the colleges lend it to them. The parents pay back the loan with interest over a time period set in advance. The colleges love this arrangement, because it allows them to make a nice profit. If you pay the entire amount without borrowing, the colleges invest your money in taxable investments, which (because of their tax-exempt status) they don’t have to pay taxes on. If you borrow the money from the college, they charge you interest on the money you borrow. Whatever course you pursue, the revenue the colleges earn from these prepayment plans more than make up for any tuition increases.

Is Prepayment a Good Idea for the Parent?

While the colleges may tell you that you will save money by avoiding tuition increases each year, your savings, if any, really depend on what interest rates are doing. If you would have to borrow the money to make the prepayment, the question to ask yourself is whether your after-tax cost of borrowing will be less than the tuition increases over the four years. If so, prepayment may make sense.

If you can afford to write a check for the entire amount of the prepayment, the question to ask yourself is whether the after-tax rate of return on your investments is higher than the rate at which tuition is increasing. If so, then prepayment makes no sense.

Any prepayment plan should be examined carefully. What happens if the student drops out after one year? What happens if the program is canceled after only two years? What is the interest rate on the loan you take out? Is the loan rate fixed or variable, and, if variable, what is the cap? These are a few of the questions you should ask before you agree to prepayment.

However, unless the interest rates are extremely low—and will remain low over the four years your child is in college—prepayment may end up costing you more money than paying as you go.

ROTC and the Service Academies

The Reserve Officer Training Corps has branches at many colleges. To qualify for ROTC scholarships you generally need to apply to the program early in the senior year of high school. Competition for these awards is keen, but if a student is selected he or she will receive a full or partial scholarship plus a $100-per-month allowance. The catch, of course, is that the student has to join the military for four years of active duty plus two more years on reserve. While on active duty, many students are allowed to go to graduate school on full scholarship. A student can join a ROTC program once he’s entered college, but will not necessarily get a scholarship.

To qualify for the four-year scholarships, students (male and female) must have good grades, an SAT score of 1100 (out of 1600) or an ACT score of 24, they must pass a physical, and they must also impress an interviewer.

The service academies (the U.S. Military Academy at West Point and the U.S. Naval Academy at Annapolis are probably the best known) are extremely difficult to get into. Good grades are essential, as is a recommendation from a senator or a member of Congress. However, all this trouble may be worth it, for the service academies have a great reputation for the quality of their programs and they are absolutely free. Again, in exchange for this education, a student must agree to serve as an officer in the armed forces for several years.

Outside Scholarships

Opinions are divided about outside scholarships. The companies that sell scholarship databases say there are thousands of unclaimed scholarships sponsored by foundations, corporations, and other outside organizations just waiting to be found. Critics charge that very few scholarships actually go unclaimed each year, and that the database search companies are providing lists that families could get from government agencies, the local library, or the internet for free.

Certainly it must be said that many scholarships in the search services’ databases are administered by the colleges themselves. There is almost never a need to “find” this type of scholarship. The colleges know they have this money available, and will match up the awards with candidates who meet the requirements attached to the awards. It is in the colleges’ interest to award these “restricted” scholarships since this frees up unrestricted funds for other students. Every year, colleges award virtually all the scholarship money they have at their disposal.

It must also be pointed out that when you notify a college that you have won an outside scholarship (and if you are on financial aid you are required to tell the school how much you won), the college will often say thank you very much and deduct that amount from the aid package they have put together for you. As far as the colleges are concerned, your “need” just got smaller. Thus if you hunt down an obscure scholarship for red-haired flutists, it will often not really do you any monetary good. Your family contribution (what the colleges think you can afford to pay) will stay exactly the same. The FAOs will use the outside scholarship money to reduce your aid (often your grants).

This is not to say that there aren’t circumstances when outside scholarships can help pay for college, but you must be prepared to fight. If you have found outside scholarships worth any significant amount, you should talk to the FAO in person or on the phone and point out that without your initiative, the college would have had to pay far more. Negotiate with the FAO. He may be willing to let you use part of the scholarship toward your family contribution, or at least he may improve your aid package’s percentage of grants versus loans.

We’ve talked to people who’ve had terrible experiences with the scholarship search companies and we’ve talked to other people who swear by them. Just keep in mind that this type of aid accounts for less than 5% of the financial aid in the United States. Of course, 5% of the financial aid available in the United States is still a lot of money.

We do recommend, however, that you steer clear of any scholarship search firm that promises you’ll get a scholarship or your fee will be refunded. These guarantees are not worth the paper they’re printed on. When you read the fine print, you’ll discover that you need to send them rejection letters from each and every scholarship source they recommended to you. Many of these donors don’t have the time or the resources to tell you the bad news, so you’ll never get the proof you need to claim your refund. The Federal Trade Commission has closed down a number of these firms after receiving numerous complaints from students and parents who didn’t get their money back.

Innovative Loans

The very best type of loans, as we’ve said before, are the government-subsidized student loans. We’ve also already discussed home equity loans and margin loans (both of which reduce the appearance of your assets) as well as some of the more popular parent loan programs.

There is one other type of loan that can help you write the checks:

Borrow from Your 401(k) Plan or a Pension Plan

If you are totally without resources, the IRS may allow you to make an early withdrawal of money without penalty from a 401(k) plan to pay for education. However, rather than get to this desperate situation (which will increase your income taxes and raise your income for financial aid purposes), it would make a lot more sense for you to take out a loan from your 401(k) plan or from your pension plan.

Not all plans will allow this, but some will let you borrow tax-free as much as half of the money in your account, up to $50,000. There are no penalties, and this way you are not irrevocably depleting your retirement fund. You’re merely borrowing from yourself; in many cases, the interest you pay on the loan actually goes back into your own account. Generally, the loan must be repaid within five years. However, if you lose your job or change your employer, this loan will become due immediately, so you should exercise some caution before you proceed.

This kind of borrowing will not decrease your assets as far as the FAOs are concerned because assets in retirement provisions are not assessed anyway. However, if you’ve come to this point, your non-retirement assets are probably already fairly depleted.

A self-employed individual can borrow from a Keogh plan, but there will almost certainly be penalties, and the loan will be treated as a taxable distribution. Loans against IRAs are not currently permitted.

Loans Forgiven

A few colleges have programs under which some of your student loans may be forgiven if you meet certain conditions. At Cornell University, for example, Tradition Fellows, who hold jobs while they are in college, are given awards that replace their student loans by up to $4,000 per year in acknowledgment of their work ethic. Even federal loans can be forgiven under certain circumstances. Head Start, Peace Corps, or VISTA volunteers may not have to repay all of their federal loans, for example.

Moral Obligation Loans

Here’s a novel idea: the college makes a loan to the student, and the student agrees to pay back the loan. That’s it. There is no legal obligation to pay back the money. The student has a moral obligation to repay. Several schools have decided to try this, and the results, of course, won’t be in for some time. At the moment, when a student repays the loan, the repayment is considered a tax-deductible charitable contribution. The IRS will probably have closed that loophole by the time your child is ready to take advantage of it. Nevertheless, this is a wonderful deal because it allows the student flexibility in deciding when to pay the loan back, and does not affect the child’s credit rating. If your college is offering this option, grab it.

Payment Plans and Financing Options

Many families have difficulty coming up with their Family Contribution in one lump sum each semester. There are a number of commercial organizations that will assist you with spreading the payment out over time. Some of these programs are financing plans that charge interest and involve repayment over a number of years. Others are simply payment plans in which you make 10 or 12 monthly payments during the year. These plans may require you to begin making payments in May or June prior to the start of the fall semester. A nominal fee (about $50) is usually charged for these plans. The two largest organizations that offer such budgeting plans are: Sallie Mae’s Higher One TuitionPay [(800) 635-0120]; and Tuition Management Systems (TMS) [(800) 722-4867]. Many schools have developed their own deferred payment plans as well. These programs can vary tremendously from college to college.

The college financial aid office or bursar’s office should be able to provide you with information regarding all your payment options, as well as the names of those commercial plans (if any) that can be used at their school. Be sure to read the fine print before you sign up for any of these programs.

Tuition Refund Insurance

Writing that check for the first tuition bill is a sobering experience for most families. Given the large outlay of funds involved, it may make sense to take out a tuition refund insurance policy to protect yourself if the student is forced to withdraw in the middle of a term. Most colleges do give partial refunds when a student has to withdraw. How much money you get back from the college itself depends on how far into the term the student is when he/she withdraws, as well as the policies of the individual school. (There are no federal regulations governing how much money must be refunded, if any)

Tuition refund insurance—also known as tuition insurance—is designed to make up the difference. For an insurance premium of normally $150 to $400 per academic year, you can have peace of mind that any non-refunded payments for tuition and possibly room & board are not a total loss.

Bear in mind that if the student withdraws midway through the term—regardless of the reason—the school will probably not permit the student to finish the coursework after the semester is over. More than likely, the only option will be to re-enroll for the course in a future term.

For medically- related withdrawals you can often get up to 100% of what the college doesn’t refund if you have taken out a tuition refund insurance policy. For mental health issues, you can often get up to 60 or 70%. Some policies also offer coverage if the student is forced to withdraw for other reasons—such as a death in the family or an employment-related relocation of the parents). Keep in mind that as the academic term progresses, you will get back less money from the school. So if there are issues that make the student’s ability to complete the term unlikely, it makes sense to make a decision sooner rather than later—and to notify the school through the proper channels and withdraw relatively quickly.

Of course, if the student is at a lower-priced state school or is getting a lot of financial aid, tuition refund insurance makes less sense. But at the very least, you should carefully review the college’s refund policy. And if you are considering purchasing a policy, you should be sure to read all the fine print since some refund policies will not pay a benefit if the student withdraws due to a pre-existing medical condition that was present within a certain time period before the policy was purchased.

National Service

One of the nontraditional methods of educational financing has been the AmeriCorps program (www.Americorps.gov). Since it was established in 1994 during the Clinton administration, more than a quarter million individuals have participated in this national service program designed to encourage young people to serve in educational, environmental, or police programs or in programs to assist the elderly or the homeless. In return for taking part in national service, a participant receives training, a living allowance at the minimum wage, health insurance, child care, and up to $5,550 per year in educational grants.

While we think this is a generally great idea, the program in its current form has a few problems from a financial aid standpoint. First, if a student joins this program after he or she has graduated, the student will not be able to use money from this program to pay college bills directly. Students would have to come up with the money in the first place. Only later could AmeriCorps grants be used to pay back loans that the student had taken out along the way. Second, with a maximum of only $5,550 per year in grant money, national service may not be the most economically efficient way for a student to pay back student loans. Unless national service appeals to you for altruistic reasons, you may be able to repay loans faster by taking a conventional job and putting yourself on a minimum wage allowance. Finally, for students who participate in the program prior to college and who demonstrate need when they apply for financial aid, the AmeriCorps grants may simply reduce those students’ “need” in the aid formulas and not the family contribution. This is why many higher education organizations have criticized references to national service as a student aid program.

Marketing Gimmicks Arrive on Campus

Some colleges have begun incentives that owe more to the world of retailing than to the world of the ivory tower. Among the offers you may find:

✵ discounts for bringing in a friend

✵ rebates for several family members attending at the same time

✵ discounts for older students

✵ reduced prices for the first semester so you can see if you like it

✵ option of charging your tuition on a credit card