Summary and Analysis of The Euro: How a Common Currency Threatens the Future of Europe - Joseph E. Stiglitz (2016)

Part III. MISCONCEIVED POLICIES

Chapter 7. CRISES POLICIES: HOW TROIKA POLICIES COMPOUNDED THE FLAWED EUROZONE STRUCTURE, ENSURING DEPRESSION

Those outside of Europe—and many in Europe—have been appalled at the unfolding drama in the crisis countries, especially Greece, Spain, Portugal, and Cyprus. Pictures abound of middle-class individuals suddenly in jeopardy: retirees whose pensions have been cut to the bone; and young people, college graduates, who have looked and looked for a job and can’t find one, living in homeless shelters. These stories tell us that something is wrong. So, too, do youth unemployment rates of 30 percent or more. It wasn’t this way before the euro.

My wife and I gently tried to confront the prime minister of one of the northern European countries at a private meeting in 2013. Was he aware of how bad things had become? News articles that fall and winter had described formerly middle-class families in Spain and Greece scavenging for survival, unable to afford to heat their homes in winter, even eating out of garbage cans.1

His cold reply, delivered with a gentle smile, was that they should have reformed their economy earlier; they should not have been so profligate. But, of course, it was not these individuals who had been profligate, who had failed to reform. Innocent citizens were being asked, forced actually, to bear the consequences of decisions that had been made by politicians—ironically, often politicians from the same political party of the right that the Troika seemed so fond of.

The lack of empathy on display at that dinner—the lack of European solidarity—has been in evidence repeatedly. Bad enough was the scolding and flippancy of those like the prime minister we spoke to, as the guiltless citizens of the worst hit countries suffered real privation. Yet the biggest display of callousness has not been in any politician’s comments, public or private, but in the actual policies that the Troika has foisted on these countries in their moments of desperation. These policies have compounded the crises, weakened the hard-fought bonds of European unity, and magnified the in-built frailties and flaws of the eurozone’s structure.

Astonishingly, even with the avalanche of evidence that the Troika’s programs have failed the people of the countries they were supposed to help, its leaders have been claiming success for their austerity. This stretch of imagination—that Spain, Portugal, and Ireland were success stories—could only be achieved by wearing blinders that hid all but the most limited economic indicators from view. Yes, the Troika’s 2010-2013 Economic Adjustment Programme for Ireland had brought the country’s financial sector and government back from the brink of total economic collapse.2 But the austerity the Troika imposed helped ensure that Ireland’s unemployment rate remained in double digits for five years, until the beginning of 2015, causing untold suffering for the Irish people and a world of lost opportunities that can never be regained. (For comparison, the United States’ unemployment rate peaked at 10 percent for just one month in 2009 during the Great Recession.)

And Ireland was one of the best cases. In 2011, the IMF bailed out the Portuguese government as it faced spiraling borrowing costs in the wake of the global financial crisis. Its cash injection of €78 billion came with strings attached, of course. The government was required to lower its deficit from nearly 10 percent of GDP in 2010 to 3 percent in 2013.3 Barring strong economic growth, the only way to achieve that reduction was austerity—reductions in government spending, such as lowered wages for public servants, and increases in taxes. (Without such assistance, of course, Portugal would have had to have even more drastic cutbacks, because it, too, was cut out from capital markets.) The IMF has also claimed its Portugal program as a success. And indeed, if all one cares about is the lending rate for the government, the bailout achieved its aims. Portugal went from paying 13 percent on its 10-year bonds at the end of 2011 to paying less than 3 percent by the end of 2014 (when the program ended),4 among other improvements to the government’s fiscal position and borrowing abilities.5 Yet austerity kept the fundamentals of the economy feeble. By 2015, GDP per capita was still down an estimated 4.3 percent from before the crisis.6 Unemployment was still above 12 percent in early 2016. Growth predictions in the next years are sluggish: the IMF estimates that GDP will not expand more than 1.4 percent annually at any point in the next several years. The government might be borrowing with more ease, but the Portuguese people never experienced a real recovery.

Although Spain’s 2012 bank bailout didn’t come with direct conditions requiring reduced government spending or higher taxes, after 2008 the country still swallowed the austerity snake oil being hard-sold on the continent. A commonsense look at the data—and the hundreds of thousands of indignados who marched in the streets in 2011—showed that these policies’ legacy of evictions, wage cuts, and unemployment was anything but a triumph. Yet in mid-2015, with nearly a quarter of the Spanish workforce still unemployed, the German Council of Economic Experts (along with many other austerity boosters) was claiming Spain as the prime example of the virtues of austerity.7

It was with these fundamental perversions of the definition of economic success that the Troika blundered forward to its worst misadventure yet, in Greece. There, its program has been wrong, destructive, and almost unbelievably narrow-minded. More than that, it has bordered on inhumane. Still, in 2015 the Troika doubled down on its manmade disaster.

For instance, as Greece entered its third “program” in the fall of 2015, Europe demanded that Greece end a program of “forbearance” against those who owed money on their mortgages: in order to save great swaths of its population from homelessness and deeper destitution, Greece had implemented a temporary ban on home foreclosures when the crisis set in.8 The ban was still in effect in 2015, but with many amendments that had reduced the scope of loans it covered. (The Troika often masquerades its “demands” as simply “proposals,” things that the crisis country should consider. But they are more than proposals—Greece had to accede to them. There are “negotiations,” but as the story of the “foreclosure proposal” illustrates, in the end typically what is “agreed” is little different from what was originally proposed, though there may be a few cosmetic changes, a face-saving gesture to enable the crisis-country government to swallow the bitter medicine.)

The leaders of the Troika appear to believe that those not paying their mortgages are deadbeats who are exploiting the foreclosure ban to take a holiday from their bills. Be tough, and the deadbeats will pay. The reality, though, is otherwise. With the depression, with hundreds of thousands out of a job, hundreds of thousands more having to take massive pay cuts of 40 percent or more, most of those not paying can’t pay. Europe was betting that toughness would yield a bonanza for the banks, and the amount Europe would need to recapitalize them would be reduced accordingly. More likely, though, is that thousands of poor Greeks would join the homeless, and the banks would be saddled with homes that they could not sell.9

Greece pleaded with the Troika to soften its draconian demands. But the Troika held fast, ordering severely watered-down protections: only those with an income below €23,000 a year would still be fully protected.10 Of course, families with such a low income typically don’t own a home, so the exemption meant little. Greek officials capitulated and wanly claimed that the majority of Greeks would be eligible for some protection—a claim that seemed thin. What was unambiguous was that many on the brink of destitution had been pushed a few more inches toward the edge.

The technocrats of the eurozone were not focused on the statistics that captured this suffering. Nor did they see that beneath the cold statistics were real people, whose lives were being ruined. Like the airplane bombing from 50,000 feet, success is measured by targets hit, not by lives destroyed.

The technocrats were interested in different statistics: interest rates and bond spreads (how much extra those in the crisis countries have to pay to borrow money), budget and current account deficits. Unemployment rates sometimes seemed just a measure of collateral damage, or, more positively, a harbinger of better times ahead: the high unemployment rate would drive down wages, making the country more competitive and correcting the current account deficit.

Perhaps the one advantage of the Troika’s Greek tragedy is that it provides a paradigmatic example of the problems with the eurozone’s policy response to the global financial crisis and its aftermath. While in this chapter and the next I discuss the case of Greece in special detail, it should be kept in mind throughout that the policy mistakes the Troika forced on Athens in its time of need are simply amplified versions of those it established through pressure, cajoling, and loan conditions in other crisis-hit countries.

THE IMPERATIVE TO DO SOMETHING

As the crisis in the eurozone unfolded in early 2010, the leaders of the currency union had to do something. Bond yields were soaring—long-term Greek interest rates started the year at 6 percent and reached 12 percent by December.11 The real crunch, however, arrived when it came time for Greece to borrow more, to finance its huge fiscal deficit (10.8 percent of GDP in 2010) and to repay loans coming due. No one would lend. And if the government couldn’t borrow, they couldn’t repay what was owed. Default was the next step. But if Greece defaulted on its bonds, those who owned the bonds would be put into a more precarious position. German and French banks, let alone Greek banks, that held significant amounts of these bonds might themselves become insolvent. Worse, because of the lack of transparency in the financial market, no one knew exactly how each bank would be affected. Some banks that had not lent to Greece may have lent money to other banks that had, so they, too, might be at risk. Some banks had bought insurance against losses, but some banks had gambled, taking bets that Greece would not default. It was a mess. And it was a mess that could spread. The world had just experienced a dose of this kind of contagion: in the aftermath of the collapse of Lehman Brothers, the entire world went into an economic recession, as financial markets froze. It was not clear whether Greece was small or large relative to Lehman Brothers; most importantly, it was not clear whether it was systemically significant.

In chapter 1, I described how as each country went into crisis, the Troika formulated a program supposedly designed to bring the country back to health, and for the countries that had lost access to international credit markets, to regain access. Here was the critical flaw: a focus on access to capital markets and the repayment of debts owed, rather than the restoration of growth and an increase of living standards of the people of the country. Not a surprise: finance ministers naturally focus on financial markets. But the European project was not supposed to be about financial markets—they were simply a means to an end. The means became an end in itself.

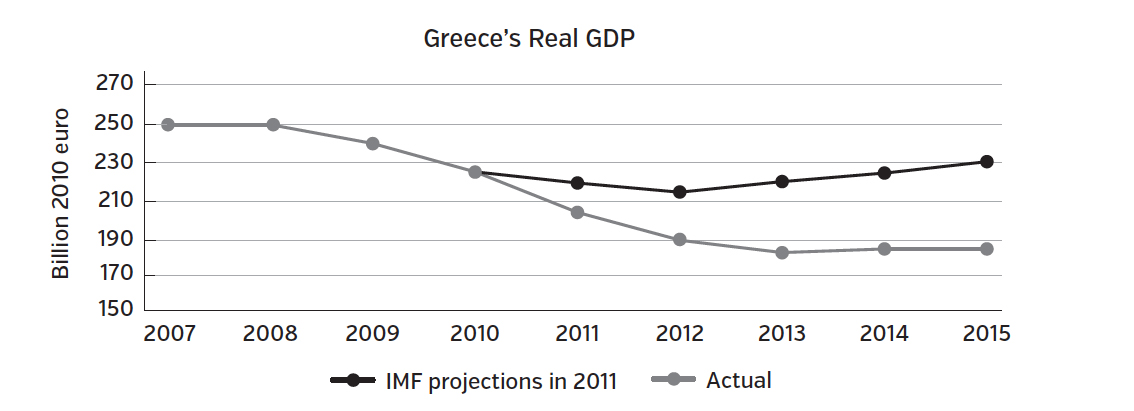

As one program after another unfolded, as one country after another went into crisis, two things stood out: (1) each country that undertook one of the programs went into a deep downturn, sometimes a recession, sometimes a depression, from which recovery was at best slow; and (2) these outcomes were always a surprise to the Troika, which would forecast a quick recovery after an initial drop, and when the predicted recovery didn’t occur, Troika proponents would argue that it was still just around the corner. Figure 7 shows, for instance, in the case of Greece what the Troika thought would happen as a result of their initial program in May 2010 and what actually happened. They realized that there would be a downturn, but they predicted a quick turnaround.12 By 2015, just four years later, the economy was nearly 20 percent below where they thought it would be.13

These dismal forecasts made it clear: the Troika’s grasp of the underlying economics was abysmal. While the Troika now might want to shift blame—the country had not done what it was told to do—the truth is otherwise: Greece’s depression wasn’t because Greece didn’t do what it was supposed to; it was because it did. So, too, for the other crisis countries. Their downturns were largely because the countries had faithfully followed the Troika’s instructions.

This and the next chapter explore more closely what Europe did to achieve such adverse results. I look at the programs imposed on the crisis countries and show that these programs would inevitably lead to deep recessions and depressions. I also explain why the negative effects were even larger than what most of the standard economic models had predicted.

FIGURE 7

There were alternative policies that would have set these countries on the road to recovery—a growth policy rather than austerity, and a deep debt restructuring. This chapter will focus on the macroeconomic policies—those aimed directly at the budget, at deficits and debt. It is the macroeconomic policies that have resulted in the downturns, recessions, and depressions plaguing Europe.

The next chapter continues the discussion of the programs, focusing on the structural policies that were imposed on the countries, policies directed at reforming particular markets, in an attempt to make the crisis countries more competitive.

Much of the discussion of this and the next chapter focuses on the Greek program, simply because that program highlights more clearly than any of the others the problems of all of the programs imposed on the crisis countries and because it illustrates most clearly the mindset of the Troika.

THE MACROECONOMIC FRAMEWORK OF THE CRISIS PROGRAMS

The leaders of Europe like to think of the crisis programs as providing both symptomatic relief—getting over the immediate problem—and creating the basis for long-term adjustment. More accurately, one can think of the programs as mechanisms to ensure that debtors pay the costs of adjustment and creditors get repaid.

Added to the mix is a large dose of politics: some of the creditor countries, particularly Germany, did not want its taxpayers to know the costs that might be imposed on them; they wanted their citizens to believe that they were going to be repaid, even if that was essentially impossible. There is a high price associated with such a charade, with most of the costs borne by Greek citizens, for instance. But even Germany is likely to bear some of the costs, because of the reduced probability of repayment.

Politics affects creditors and debtors alike, and Greece provides the best example of this interplay. Germany and the Troika imposed harsh conditions on the government of George Papandreou14 after it had uncovered and transparently disclosed budgetary chicanery by the previous Greek government. The punishment paved the way for the return of the Samaras right-wing government that had actually put Greece in its impossible position.15

In effect, rather than punishing the party that had acted badly, the Troika had rewarded it. It was even worse: when in power, the Papandreou government had begun a process of curtailing the power of the Greek oligarchs, who had a controlling interest in banks and the media and were exploiting the linkages between the two. But the New Democracy party of Samaras was closely linked with the same oligarchs, and it was no surprise that upon his return to office, the Papandreou reforms were reversed, without a peep out of the Troika. Thus the Troika programs were counterproductive when it came to encouraging the most fundamental reforms that were widely seen as necessary for long-term shared prosperity in Greece.

Fiscal balance can be restored by cutting expenditures and raising revenues. The social and economic consequences depend greatly on which expenditures are cut and how revenues are raised. Under Troika programs not only was there too much emphasis on restoring fiscal balance, but they also went about restoring balance the wrong way: the programs resulted in more adverse effects on output, employment, and societal well-being than was necessary. The IMF especially should have known that poorly designed tax measures can backfire—tax revenues can fall, and so, too, can economic output.

In the sections that follow, we take up different aspects of the macroeconomic policies imposed on the crisis countries.

AUSTERITY: THE MYTH OF THE SWABIAN HOUSEWIFE

At the center of the macroeconomic programs was austerity—a contraction in government spending and an increase in revenues. While the authorities in Europe seemed surprised by the strongly adverse outcomes that were so much worse than their models predicted, I was surprised that they were surprised. As we have noted in earlier chapters, austerity has never worked.

THINKING ABOUT AUSTERITY

In some ways, it was not a surprise that the leaders of the eurozone would demand that Greece cut its deficit. The crisis in Greece seemed to stem from the fact that the government couldn’t borrow more, and the country had had a very large and unsustainable deficit for years. This logic though did not apply to Spain, for instance, where the crisis arose from the banking sector, and where, as we have repeatedly noted, the country had had a surplus before the crisis—the crisis had caused the deficit, not the other way around.16

The obvious immediate goal was to make it so the countries wouldn’t need to borrow more, and that’s where the austerity programs fit in: cut expenditures and raise taxes enough, and there would be no need for outside finance. But such matters are not so simple. Austerity leads to economic slowdowns, lowering revenues and increasing social expenditures on items like unemployment insurance and welfare; any improvement in the country’s fiscal position is much less than expected, and the suffering is much greater than expected.

This is the fundamental difference between the Swabian housewife, which Germany’s chancellor Angela Merkel so famously talks about, and a country: the Swabian housewife has to live within her budget, yes, but when she cuts back on her spending, her husband doesn’t lose his job. If he did, the family would obviously be in much worse shape. Yet that’s exactly what happens when austerity is imposed on a country: the government cuts spending, and people lose their jobs.

There is a better analogy than the Swabian housewife, and that is between a country and a firm. In the case of firms, we focus on the balance sheet. No one would ask about the size of the liabilities; they want to know what the assets are and what the net worth is. If a firm borrows to buy assets that increase its net worth, it’s a good move. Countries that borrow to finance investments in, say, infrastructure, education, and technology can be better off, and especially so if there are underutilized resources (unemployment). Austerity is then bad both in the short run—it leads to higher unemployment—and in the long—it leads to lower growth.

PRIMARY SURPLUSES

The Troika focused its attention on the size of the primary surplus in the crisis countries, the excess of revenues over expenditure net of interest payments. This was understandable, given the interests of creditor countries like Germany. They wanted to be paid back, naturally enough. But obviously, a country that is borrowing can’t repay. The only way the government can repay what is owed is if it runs a surplus. That such a surplus would normally lead to a weak economy is obvious: when the government has a surplus, it is taking away from the purchasing power of its citizens more than it is adding back through its spending. Thus, it is contributing to a lack of demand.

Sometimes, something else can make up for the shortfall. The United States had a primary surplus in the latter part of the 20th century, under President Clinton, but it had an economic boom driven by the tech bubble. The high level of investment sustained the economy. But when the tech bubble broke, the country quickly went into recession.

Germany, of all countries, should understand this. At the end of World War I, Germany was made to pay reparations by the Treaty of Versailles. To finance the reparations, it would have to run a surplus. Keynes correctly predicted that German reparations and the resulting German surplus would cause a German recession or worse. The depression in Germany that followed had disastrous political consequences not just for Germany but for the entire world. For a while, Germany avoided the depression by borrowing from the United States to sustain demand. But with the Great Depression in the United States, this source of funds was cut off, and Germany, too, went into depression.

Given the history, it is shocking that Germany and the Troika have demanded that Greece and other crisis countries maintain large primary surpluses. In the case of Greece, it insisted that the primary surplus reach 3.5 percent by 2018.17 Even the IMF knows that such a target will only extend and deepen the country’s ongoing depression. The current program allows easier targets for 2015-2017, but if Greece complies with the agreement’s primary surplus target for 2018, no matter how faithfully it fulfills the structural reforms, no matter how successful it is in raising revenues or cutting back on pensions, no matter how many are left to die in underfinanced hospitals, the depression will continue.

THE DESIGN OF THE AUSTERITY PROGRAMS

The basic design of the program sets fiscal targets, scaling down the primary deficit and eventually reaching a primary surplus. In the earlier agreements between Greece and its “partners,” the fiscal targets were almost never met—simply because the Troika was using fictional forecasts.18

Now, in the “memorandum” of August 19, 2015, if the targets are not met, as they almost surely won’t be, additional doses of austerity become automatic. While previously, austerity led to contraction, there was always the hope that the Troika would relent as it saw the magnitude of the contraction induced. Now it’s a built-in destabilizer, which guarantees a deep downturn. As the economy weakens and tax revenues fall, tax rates will have to increase—and this will depress the economy still further. (Even conservatives in the United States have argued that when the economy weakens, tax rates should be reduced, not increased.) And as the market comes to realize this, the adverse effects will be all the larger.

HIDDEN AGENDAS

Even if one were fixated on the fiscal deficit, there are fiscal policies that could stimulate the economy without increasing current deficits. These deploy the principle of the balanced-budget multiplier. If one imposes a tax and spends the resulting revenue—so the deficit is absolutely unchanged today—the economy expands. The expansionary effect of the spending outweighs the contractionary effect of the tax. And if the expenditures are well chosen—say, on teachers rather than wars—and so, too, the taxes—say, on the wealthy—then the “balanced-budget multiplier” can be large: a dollar of increased spending can induce much more than a dollar of increase in GDP. Furthermore, if the money is spent on long-lived investment goods, increasing productivity, the resulting increase in future tax revenues puts the government’s long-run fiscal position in a better shape.

Some eurozone countries have done the opposite. France, for instance, has lowered the corporate income tax, and to offset the decrease in revenues, cut spending. The balanced-budget multiplier predicts that the result will be a contraction in the economy. What France has been betting on is that the lowered corporate income tax will lead to more investment, improving aggregate supply and demand. But what is holding back investment in France and elsewhere in Europe among large corporations is lack of demand for their products. Without demand for their products, firms will not invest, even if the tax rate were close to zero.

Moreover, even if there were demand for the company’s products, both theory and evidence questions the importance of the corporate tax rates as a driver for investment. The reason is simple. Most investment is financed largely by debt. What firms care about is the after-tax cost of these funds. If they have to pay 10 percent interest, but the tax rate is 50 percent, since they can deduct all of their interest payments, the after-tax cost is only 5 percent. In effect, the cost of the investment is shared with the government, which picks up half the tab in the form of reduced taxes. The higher the tax rate, the lower the cost of funds to the firm. By itself, this would suggest that the higher the tax rate, the more investment; but, of course, higher taxes also reduce the returns from the investment. What matters is the balance between these two effects—and a close look at that shows that there is little effect on investment.

If France wanted to stimulate its economy, it should have lowered taxes on corporations that invested in its country and created jobs, and increased them on those that did not.19

That the balanced-budget multiplier was virtually never even discussed with respect to the eurozone crisis implies a hidden agenda: downsizing government, decreasing its role in the economy. This conclusion is reinforced as we look more closely at the details of the austerity programs.

INCREASING REVENUES

The programs had two key ways of raising revenues: taxation and privatization.

DESIGNING TAX INCREASES

Normally, the IMF warns of the dangers of high taxation. They worry about the disincentive effect, the discouragement to work and savings. Yet in Greece, the Troika has insisted on high effective tax rates even at very low income levels. For instance, they insisted on (and secured) a value-added tax of 23 percent on a large number of products and services, which, combined with an income tax that even at very low levels of income is at around 22 percent, made for an effective tax rate close to 40 percent.

All recent Greek governments recognized the importance of increasing tax revenues, but mistaken tax policy can hasten an economy’s destruction. In an economy where the financial system is not functioning well, where small and medium-size enterprises can’t get access to credit, the Troika demanded that Greek firms, including mom-and-pop operations, pay all of their taxes ahead of time, at the beginning of the year, before they have earned any money and before they even know what their income is going to be.

The requirement is intended to reduce tax evasion, but in the circumstances in which Greece finds itself, it destroys small businesses. While the Troika has talked about structural reforms with positive supply-side effects, this measure alone probably has a stronger negative supply-side effect than all of their structural reforms put together. Such draconian measures inevitably lead to more tax evasion—again seemingly in contradiction to another major thrust of the Troika programs.20

This new tax requirement seems at odds, too, with another of the demands Greece has confronted: that it eliminate its withholding tax on money sent from Greece to foreign investors. Such withholding taxes are a feature of good tax systems in countries like Canada, and are a critical part of tax collection. Evidently, it is less important to ensure that foreigners pay their taxes than Greeks do. This measure takes on special meaning when it is noted that allegedly one of the largest nonpayers of taxes is the German company that managed Athens airport until 2013. According to some, this company is hundreds of millions of euros in arrears.21 Obviously, if one thinks that the government is not good at collecting taxes, an irresponsible foreign investor will try to get his money out of the country without paying taxes. Possession is nine-tenths of the law. In this case, it may be ten-tenths. It then becomes very difficult for the government to recover such amounts.22

There is among economists broad agreement about the central ingredients of a good tax system. A good tax system should not “distort” the economy any more than is necessary. That’s why taxes on land and natural resources are desirable—the amount of land doesn’t change no matter what the tax imposed. More generally, a good tax system levies taxes on items where impacts on demand or supply are limited. With high and increasing inequality, a good tax system has to be sensitive to who bears the burden: it should be disproportionately on the rich, not the poor. Finally, well-targeted taxes can help restructure the economy, for instance, by promoting renewable energy and by discouraging polluting activities.

The Troika’s tax demands—say, in the case of Greece—violate these principles. Tourism provides another instance where the Troika’s tax demands are likely to be counterproductive. Especially in the niche in which Greece competes, tourists comparison shop. Greece was concerned about a higher value-added tax’s impact on tourism, especially in the country’s islands, which face high transport costs. High taxes would lower demand for Greek tourism, simultaneously hurting employment, GDP, and Greece’s current account—and tax revenues might actually decrease. But the Troika would hear none of this.

Many of Greece’s problems in tax compliance are similar to those among small businesses everywhere, especially so in a cash economy. Yet, Troika policies effectively encouraged those in countries with financially precarious governments to move their money out of banks.23

The Troika undermined tax collection in other ways: when taxes are viewed as imposed by outsiders at high levels, in ways that make no sense (for example, exempting foreign transfers from withholding taxes, forcing small businesses to pay taxes a year ahead of time), resentment builds, and trust and voluntary compliance erode. The taxes are not viewed as the product of democratic consensus but as the imposition of foreigners—hypocritical foreigners who do not even pay the taxes they owe.24 And then when the numbers and pay of tax collectors are cut—along with their job security—there is inevitably demoralization of those responsible for tax collection.

There were alternative taxes, more consistent with the basic premises of a good tax system. Property taxes can be a good thing—a key part of a good tax program—but the Troika couldn’t even get that one right. The one asset in a country that is not movable is its land. Not only is land not movable but it is inelastically supplied: the amount of land does not decrease when one taxes it more. There has long been a strong presumption in favor of land taxes.25

Under the Troika programs, Greece had adopted a new property tax, but with their small property the only thing separating many ordinary Greeks from outright poverty, the tax was deeply resented. The strict enforcement of the tax against unemployed people with no source of income would mean the loss of their major asset. What should have been deployed was a progressive property tax, on all large property holdings.

A problem which the Troika should have recognized early on was the absence of a comprehensive national property register. But this gap could easily have been remedied: individuals could have been asked to declare all of their property holdings, with a description—for example, the number of rooms, whether there is a pool, and a value. Modern technology, including satellite imagery, allows the verification of at least some aspects of the description. Individuals who do not report accurately their holdings could be threatened with the loss of their property, and a special tax could be levied on large houses and on pools (but not so large that it would pay people to fill in their pools). The government could be given the right to purchase the property at, say, 125 percent of the declared value—providing a clear incentive for honest reporting. The law also could require that the beneficial owner of all properties be declared.

Well-considered tax policy can correct for market failures, generating a double benefit—tax revenue as well as improved economic efficiency. Perhaps the most important market failure the world faces today concerns climate change—we do not price carbon. Greece has a rich potential abundance of renewable energy, both solar and wind. Besides, developing these industries would reduce its consumption of oil. One of the country’s industries is oil refining, so if Greece consumed less, there would be more to export. Thus, a high tax on nonrenewable energy would simultaneously generate revenues and improve Greece’s balance of payments.26

We have repeatedly observed that one of the problems of the eurozone was that it eliminated the power to adjust the nominal exchange rate. But, again, in the absence of that power, tax policy could have been deployed—because Greece produces relatively few goods, consumption taxes, especially on luxury goods like high-price cars, which have to be registered in the country and are imported, would have been progressive, could have raised substantial revenues, and would have gone some way in correcting the trade deficit.

PRIVATIZATIONS

There is an alternative way of raising revenues, and that is selling state assets—i.e., privatization. Of course, such sales do not directly or necessarily improve the balance sheet of the country and its government.

Earlier in this chapter, we emphasized the importance of not just looking at a country’s debt but at its balance sheet—liabilities in relationship to its assets. The Troika and the eurozone more broadly didn’t do this. In the case of privatizations, too often they looked only at cash flow, without regard to the long-run consequences. When a country sells its assets in a fire sale, its “net worth” is decreased with long-run consequences—either less revenues for the government, because it doesn’t own an asset that yields returns, or greater costs, because it now must, for instance, pay rent for office space, having sold its own buildings.27

The best case for privatization is when the government has proven itself incapable of managing an asset well and where there are several competitors for the asset, each of which would improve the efficiency of management. The worst case for privatization is when the asset is sold to a monopolist, who uses his market power (his power to raise price above the cost of production) to exploit consumers—with consumers and firms even worse off under even an efficient monopoly than under an inefficient government operator.

Moreover, privatization gives rise to an unhealthy political dynamic: the monopolist uses its profits to buy political influence, which extends and enhances its market power. Privatization can thus result in increased corruption in addition to a less competitive and overall less efficient economy. (In Europe, corruption is more likely to take the more sophisticated form of campaign contributions rather than cash-stuffed paper envelopes, but it is corruption nonetheless.)28

When the privatization results in foreign ownership, further problems arise. First, changing taxes and regulatory structures that affect the profitability of the foreign enterprise may generate enormous political pressure from the governments of its home country. What would otherwise have been a domestic matter becomes an international affair. When the new owner of the asset or its government has political power over the country—as the Troika does over the crisis countries—the interests of the citizens may not be well served, as the provision on tax withholding of cross-border flows dramatically illustrates.29

Moreover, the flow of profits out of the country can even have an adverse effect on the balance of payments. Especially if there is a fire sale, the benefits of the inflow in the short run are more than offset by the long-term capital outflows from the repatriation of profits.

There is one special case of privatization that is particularly problematic: when the enterprise buying the asset is partially or totally owned by a foreign government. One has to ask, in what sense is it a privatization if the purchaser is a public entity? It is hard to simultaneously argue that governments necessarily are less efficient and that one should sell one’s assets to another government.

In the case of Greece, the problems with privatization have already become evident. Some of the privatizations, past and proposed, have been to enterprises owned in part by the German government (at the subnational level). As I have noted, a German company held a significant stake in the management of the Athens airport until 2013, and the proposed privatization of regional airports is to a company in which German public entities are a major partner—the German state of Hesse, the largest shareholder, owns some 34 percent of the company.

There is another unsavory aspect of at least one of the privatizations that have occurred under the Greek programs, that of the regional airports referred to earlier: one of the partners in the privatization is one of the oligarchs—anomalous since one of the main structural reforms in the Greek program should be weakening the oligarchs’ power.30

That the Troika faces conflicts of interest should be obvious. So, too, it should be obvious that neither these conflicts of interest nor the public relations issues that result have been well managed—these failures undermine confidence in the entire Troika program, not just in Greece but in all of the crisis countries, and raise troubling questions about whose interests are being served by the programs.

CUTTING SPENDING

The second part of restoring fiscal balance, after raising revenue, is cutting spending. As we noted earlier, the debts of Ireland and Spain increased not so much through ordinary spending as through bank bailouts. These two cases are so important that we will focus on them in the next section of this chapter.

The spending cuts that the Troika has imposed in the crisis countries, like the tax increases, have not been well designed. Like the tax cuts, the Troika should have focused on cuts that would have had the least adverse effects on GDP and on societal well-being. Ordinary citizens are the most dependent on public expenditures like schools, publicly provided medical care, social programs, and welfare benefits. The rich can take care of themselves. (Of course, in any country and in any program, there are inefficiencies, but the Troika programs went well beyond squeezing out such inefficiencies.) And there are other obvious options for cuts, if there were the political will to pursue them.

In the 21st century, military conflicts in the heart of Europe have been rare. This may have a little to do with the European Union itself, a lot to do with the United Nations and changed attitudes toward war, and some to do with NATO. In any case, most of the countries’ defense posture would be little affected by major cutbacks in defense expenditures: in any real attack, they would have to rely on NATO.31

There exists also a massive set of inefficient subsidies (some hidden within the tax code), often to well-off business groups, the elimination of which would lead to a more efficient economy and more equal society. Most countries (including the crisis countries), for instance, have large energy subsidies, and in particular for fossil fuels.

The irony is that a very large fraction of spending at the EU level (more than 40 percent of the EU budget) goes to distortionary agricultural subsidies, much of which goes not to small farmers but to large agribusinesses.

PENSIONS

In the case of Greece, the Troika has focused on cutting public sector pensions, which it views as outsized. It appears that this is true for some Greek pensions; others are not even enough for survival. One cannot retire in dignity with a monthly pension of under the poverty line of €665—yet 45 percent of Greece’s retirees are attempting to do that.32

Indeed, a higher fraction of older Greeks were at risk of poverty in 2013 (some 15 percent) than the eurozone average, and in early 2012—well before the demands of 2015 that almost led to the Greek exit (or “Grexit,” as it is called)—Greece was actually spending less per person 65 and over than were Germany and most other eurozone countries.33 But pensions are rightly thought of as a form of deferred compensation. The individual performed work, for which he is paid in two ways: wages today and a pension in the future. The pension is part of the contract.

Both before and after the Greek crisis of the summer of 2015, the Germans argued that Greece’s debt should not be restructured—a contract is a contract—even though it was patently clear that the debt would have to be restructured. Somehow this belief in the sanctity of contracts did not extend to pensions. Not paying a promised pension fully is, in effect, tearing up the contract.34 Worse still, cutting pensions affects the most vulnerable members of society—in contrast with a debt contract, where the lenders are financially sophisticated and understand the risks of default.

Today, around the world, there is a great deal of concern over wage theft—after the worker has performed his work, the employer doesn’t pay what is promised. The worker can’t, of course, get back his time and effort. That is why wage theft is viewed as an egregious crime. But reducing pensions from their promised level is wage theft, merely in a different form.35

Greece’s Council of State, its highest administrative court, recognized the illegality of the proposed pension cuts.36 To the Troika, the violation of these individuals’ basic rights seemed an annoyance. Its response was to demand other reforms that would “fully compensate for the fiscal impact of the Constitutional Court ruling.”37

Future pensions are, of course, different from past commitments. The level of such pensions should be seen as part of appropriate compensation packages—what is required to attract talented people to perform the important business of the public sector. Again, the Troika hasn’t framed the matter this way. If those in the public sector are not appropriately compensated, then the public sector won’t be able to fulfill its necessary tasks. Citizens will then feel, justifiably, that they are not getting their money’s worth out of their taxes, and tax compliance will decrease. Another vicious circle begins, where the Troika is clearly more a part of the problem than of the solution.

SAVING THE BANKS

The financial sector was at the center of the Great Recession, and it has been at the center of the euro crisis. As we’ve seen, a real estate bubble fueled by excess housing credit brought down Spain. And as is typical after the bursting of such a bubble, many who had taken out loans couldn’t repay, and the weakened banks curtailed lending. The cessation of a major engine of economic growth—real estate investment—combined with the curtailed lending ensured that recession would follow. In turn, government attempts to prop up the banks, combined with falling tax revenues and increased social expenditure as the economy went into recession, put the government in a precarious fiscal position.

The eurozone had been constructed on the premise that each government was responsible for its own banks. Consider the case of Spain. As Spanish banks weakened, they had to pay very high interest rates. The banks faced a crisis—they might not even be able to borrow, depositors might withdraw their funds, and the high interest rates might drive them into insolvency. The banks and the government were intimately intertwined, as we noted in chapter 5. What gave depositors in banks some confidence that they could have their money when they wanted it was the backing of the government. But the weakening of the fiscal position of the government weakened confidence in the banks. At the same time, the weakening of the government’s fiscal position meant it could only borrow at a high interest rate. Many investors were not willing to lend at all. To keep interest rates on government bonds from soaring even further, Spanish banks had to buy and hold on to large amounts of government debt. The decline in the price of Spanish government bonds then meant a worsening of Spanish banks’ balance sheets.

To an outsider, it was apparent that what was going on was a bootstrap operation: banks lent the government money (typically, by buying government bonds), and the government guaranteed the banks, allowing them to get access to money from markets at lower rates—so long as the government guarantee had much worth—and to lend some of that money to the government.

Eurozone policy toward Spain (and some other crisis countries) was in many ways predicated on this bootstrap operation, wherein lending to the government would help bail out the banks, and lending to the banks would help bail out the governments, as the banks bought government bonds when no one else was willing to do so.38

The eurozone stepped in with a variety of measures to help Spanish banks, though the Spanish government was ultimately supposed to bear the downside risk. But if the Spanish government could have borne the downside risk, it could have rescued the banks on its own. It was precisely because of the interlinking of the two that outside help was needed. Not surprisingly, the effect of such measures was at best temporary.

A “CONFIDENCE” GAME?

What finally restored stability (but not strong growth) to Europe was Draghi’s promise in 2012 to do whatever it takes to support the European sovereign (government) bond market. Sovereign spreads—the higher interest rates that Greece, Spain, and other crisis countries had to pay relative to Germany—came down. Even Greece’s spread fell from 27.3 percentage points in February 2012 to 12.0 by the end of the year. Italy, Portugal, and Spain, though never experiencing a spread as large as Greece’s, fell as well—to 3.2, 6.0, and 4.0, respectively.39 The increase in bond values improved the balance sheet of banks. It was a confidence game that was seemingly costless and has worked—at least for a while. As we noted earlier, no one knows, of course, whether the ECB in fact can and will do “whatever it takes” if that day of reckoning arrives when a periphery country, in the face of a sudden loss in confidence in that country’s bonds, needs ECB support.40

Any existing confidence in the ECB’s promise would, of course, be greatly eroded were Greece or some other member to leave the eurozone precisely because the ECB had not done whatever it takes. In the Greek crisis of the summer of 2015, the ECB showed itself resolutely unwilling to back Greece unless its government acceded to the demands of the Troika. As the negotiations ground on, the ECB went so far as to stop acting as a lender of last supply, forcing Greece’s banks to shut down for three weeks—hardly evidence of a willingness to do whatever it takes, more evidence of the political role of the ECB discussed in chapter 6.

If there is an exit from the euro of one or more members, the knowledge that the euro is not a binding commitment among its members—a commitment that will never be broken—will make the Draghi confidence trick far less likely to work the next time. Bond yields could spike, and no amount of reassurance from the ECB and Europe’s leaders would suffice to bring them down from stratospheric levels.

Even if the ECB were willing to do whatever it takes, it is not clear, short of a massive debt restructuring that the ECB could save the day. The IMF is consistently brought in to provide liquidity when there is a lack of confidence by markets. In a very large fraction of cases, the IMF fails to restore the economy to health, for two reasons: First, the IMF is a senior creditor—that is, it gets paid back before anyone else does. Thus, loans by the IMF worsen the risk profile of all other creditors; they stand further down the queue. The IMF “rescue” therefore makes these bonds even riskier.41 Secondly, the IMF typically supplies the funds with a long list of “conditionalities,” just as the Troika has done with its other members. Usually, these conditionalities are misconceived—both the macroeconomic/fiscal conditions and the structural ones. As in Greece, they almost guarantee a bigger economic downturn. And, of course, as the economy’s prospects grow dimmer, there is little reason that market confidence will be restored.42

BAILOUTS AND DEBT RESTRUCTURINGS: WHO IS REALLY BEING HELPED?

The first symptom of the crisis was the high interest rates paid by Greece on government debt (sometimes referred to as sovereign debt), followed by Greece being closed out of the market—no one would buy any new bonds that the Greek government might try to issue.

The leaders of the eurozone realized they had to do something, for if Greece didn’t pay back the loans that were due, it could spell troubles not just for Greece but for the rest of Europe. Many of the Greek bonds were held by German and French banks. The eurozone’s immediate response was to provide credit, not so much to help Greece but to help their own banks. But at what interest rate? To demonstrate to German taxpayers that they would not be subsidizing Greeks, the Troika demanded a high interest rate—so high that it was clear from the outset that Greece’s ability to repay the debts was low. If they had chosen a lower rate, that might not have been the case. At the time the crisis broke out, Greek debt was around 109 percent of GDP—lower than US debt at the end of World War II (118 percent), much lower than Japan’s debt now (246 percent) and the UK’s debt at the end of World War II (which reached some 250 percent).43 If one manages to “grow” the economy, increase GDP, and keep interest rates low, this debt-to-GDP ratio can be brought down, and dramatically so, as both the history of the United States and the UK demonstrated. But if one imposes stifling conditions and charges high interest rates, then the economy will stagnate, and the debt-to-GDP ratio will increase.

Some in Germany (and elsewhere) claim high interest rates were necessary to discourage moral hazard, the risk that governments would spend recklessly and then turn to Europe for assistance. But no government would willingly put itself through the torture that Greece has endured. Moreover, whatever mistakes in lending occurred earlier—punishing Greece today doesn’t rectify yesterday’s mistakes.

The real moral hazard problem arises for banks, who have an incentive to induce countries to borrow excessively, knowing that current politicians benefit from the increased spending and future politicians pay the price. Repeated bank bailouts encourage this kind of 'margin-bottom:0cm;margin-bottom:.0001pt;text-indent: 18.0pt;line-height:normal'>These bailouts, of course, not only distort incentives but are expensive. They are, in fact, just one of the many forms of subsidy to the financial sector, especially the big banks,44 sometimes hidden in the lower interest rate they pay to those who provide them funds because of anticipation of the bailouts. If instead of just bailing out failing banks, the governments took shares in those banks, then the country’s fiscal position would be that much stronger when the banks rebounded, and perhaps the banks would be more prudent in their lending.45

True to history, Germany and the Troika did little to address the banks’ moral hazard in the case of Greece and some of the other European bailouts. Indeed, as we saw in the case of Ireland, the ECB demanded (secretly) that Ireland bail out its banks.

Whatever the reason, Germany’s demand for high interest rates was well in excess of those at which Germany could borrow. This dealt a blow to any notion of European solidarity: What does solidarity mean if one country is able and willing to make a profit off its neighbor in its time of need?46

As it became obvious that Greece could not make the repayments, new loans were needed, with new conditions—ever more onerous. Of the total lent to Greece, less than 10 percent ever got to the Greek people. The rest went to pay back creditors, including German and French banks.47 It may be nice that the German and other European governments bailed out their banks (though whether that is good policy is another matter), but the Greeks rightly asked why it should be done so much on their backs.

A FRESH START: AN ALTERNATIVE TO DEPRESSION-GENERATING AUSTERITY

Debt restructurings are an essential part of capitalism. If a country (or a firm or a family) is temporarily facing difficulty in servicing its debt,48 then a short-term loan to help it through the troubled period makes sense. But if there is a long-term problem, the loan needs to be written down. The individual needs a fresh start. Typically, a country has a bankruptcy law to allow this fresh start. The same principle applies to nations. But there is no international law for restructuring debt—though as we noted earlier there is now a move within the United Nations to create such a framework, and a resolution establishing a set of principles for debt restructuring was overwhelmingly passed in September 2015.

Debt restructuring improves a country’s fiscal position, because the government doesn’t have to spend as much servicing the debt. The money not transferred abroad can be used to stimulate the economy. Of course, of the array of possible actions, restructuring is most disliked by the creditor countries’ governments—and even more so when the debt is owed to “official” bodies.49

The severe austerity (and the other features of the Troika programs) makes little sense even from the perspective of the creditors. It’s like a 19th-century debtors’ prison. Imprisoned debtors cannot make the income to repay. So, too, the deepening depression in Greece will make it less and less able to repay. Debt restructurings are not a panacea—they do not resolve all of a country’s problems. But without a debt restructuring, a write-down of what is owed, overindebted countries can’t return to health. In the case of Greece, the IMF has recognized the need for a debt restructuring; but even with a restructuring, unless there is relief from the extreme austerity measures now in place, the prospects for the country remain bleak.

One shouldn’t feel too sorry for the private sector creditors: typically they have been well compensated for their risk, in terms of interest rates well in excess of the safe interest rate—for example, the rate on US Treasury bills.50If they have not been well paid, it reflects a lack of due diligence on the part of the creditors or a bout of irrational optimism.51 Of course, creditor governments don’t like admitting to their citizens that they or their country’s banks have to take a loss. There are strong incentives for “pretend and extend”—pretend that the debtor is only having a temporary problem and extend the loan, so as not to “recognize” the loss. But the costs of this charade are usuallyhigh, especially to the indebted country, and that has proven to be the case particularly in Greece.

Germany has been insisting that there be no restructuring of Greece’s debt—only that there be another bout of pretend and extend. The problem with pretend and extend is that it provides no framework for a resumption of growth; it condemns the debtor country to never-ending misery; there is no fresh start. Moreover, Germany’s refusal to restructure put Greece in the impossible situation of having to agree to a program that it knew would not and could not work. The Troika program was incoherent: the Germans simultaneously said there must be no debt write-off and that the IMF must be part of the program. But the IMF cannot participate in a program where debt levels are unsustainable, and the IMF had already determined that this was the case for Greece’s debts.52

COULD GREECE PROCEED IN A RESTRUCTURING ON ITS OWN?

There is an argument that Greece should begin the process of debt restructuring on its own, if Germany doesn’t accede: even the IMF says that debt restructuring is absolutely necessary. Whether or not the current program is well implemented, it will lead to unsustainable levels of debt. The Greeks might take a page from Argentina, exchanging current bonds for GDP-linked bonds, where payments increase with Greece’s prosperity. Such bonds align the incentives of debtors and creditors.53

As we saw in earlier chapters, after Argentina restructured its debt and devalued, it grew rapidly—the fastest rate of growth around the world except for China’s—from its crisis until the global financial crisis of 2008. Of course Greece and Argentina are different economies. Argentina benefited from both a debt restructuring and a devaluation; if Greece only had a debt restructuring, would that be enough?54 Argentina benefited, moreover, from a large increase in exports as a result of the commodity boom. There are, however, some striking similarities: Both countries were being strangled by austerity. Both countries under IMF programs saw rising unemployment, poverty, and immense suffering. Had Argentina continued with austerity, there would have just been more of the same. The Argentine people rose up and said no. Greece is in a similar situation: if conditions continue as is, it will mean depression without end.

CONCLUDING COMMENTS

This chapter has focused on the macroeconomic and financial sector dimensions of the programs that have been imposed on the crisis countries. It is these that have predominantly determined the fate of the crisis countries; it is macroeconomic austerity that has led to the dismal performances.

And while in some respects, Greece was not typical of the crisis countries—in most, it was private sector misconduct, not public sector profligacy that brought on the crisis—Greece exemplifies the failures on the all-important macroeconomic front. Greece had the biggest and fastest fiscal consolidation among the advanced European economies in the aftermath of the global financial crisis, ruthlessly cutting back expenditures and raising new revenues.55

In the summer of 2011, as the first signs of the failure of the austerity policy emerged, Europe’s leaders recognized that they needed a growth strategy. They promised Greece one. They didn’t deliver. There was only more of the same. The bailouts of Spain, Greece, and the other countries in crisis appeared aimed more at saving the European banks that had lent these countries money than at restoring the crisis countries to health; it seemed aimed more at saving the euro than at preserving the well-being and economy of the crisis countries.

In the end, then, it was not so much European solidarity that engendered the “help” that Germany provided to its neighbors as self-interest. A restructuring of Greek debt might have been the most economically sensible thing to do when the crisis broke out in 2010, with Germany providing direct help to its own inadequately regulated banks. But for German politicians, it was easier to vilify Greece and provide indirect assistance to German banks through a bailout loan, called a “Greek bailout,” and then impose policy conditions on Greece that would seemingly force it to repay what was borrowed.

In the end, the economic policy didn’t work. It didn’t work for the debtor countries or for the creditor. It didn’t work for the eurozone as a whole. Greece couldn’t repay. And the Greeks paid an enormous price for Germany’s political gambit. With the ongoing euro crisis, it is too soon to tell whether it worked for Germany’s politics, for Merkel and her government.

It would have been easy to restore Greece to growth: deep debt restructuring (simply recognizing that money that can’t be repaid won’t be repaid); a primary surplus of 1 percent by 2018, not the 3.5 percent Europe has demanded; and reasonable structural reform focused on the central issues facing the economy today (which I will describe in greater detail in the next chapter).

The short-run economic consequences of the misguided programs in Greece and elsewhere are already evident. The longer-term consequences in terms of slower growth and lower GDP will only be seen over time. The best evidence is that a country that goes through a deep downturn never bounces back to make up for what is lost. What is lost is lost forever.

The social and political consequences not just in Greece but throughout the eurozone are also almost inevitable—and potentially disastrous. Indeed, already some of these are evident, with the growth of more extreme parties: the centrist parties, both the center-left and the center-right, that had staked their reputation on the success of the Troika programs and on the idea that the euro would bring prosperity for all have been discredited. More than 60 percent of voters in Spain, Greece, and Portugal have rejected the austerity parties. The Irish government was all but turned out. While these effects are felt most strongly in the crisis countries, they are also present elsewhere in the eurozone, most notably in France and Italy. And the failures in the eurozone almost surely have contributed to broader skepticism about the value of European integration, evidenced most starkly in the strong support for leaving the EU in the UK. In Spain and elsewhere, separatist parties, calling for the breakup of long-established nation-states, are in the ascendancy, reversing a 200-year trend of national political integration within Europe.

While this chapter set forth the Troika’s macroeconomic policies, the next outlines the structural reforms they imposed on the crisis countries, explaining why they, too, failed and how there were alternatives that would have worked so much better.

ACADEMICS FOR AUSTERITY: AN ASIDE

While the austerity programs described in this chapter have largely been driven by politics and politicians, not surprisingly, academic economists have raised their voices.

The vast majority have sided with the views expressed here: austerity has never worked. When the government reduces demand, output falls, unless something else fills the gap. It’s that simple. And because it is so simple, we haven’t spent much time in the text explaining why, exactly, austerity has never worked. Here, we consider how austerity doctrines have sometimes garnered support—outside of ideologues and those special interests who might benefit from austerity—and why the IMF and the Troika could have repeatedly gotten it so wrong in predicting its effects.

In the immediate aftermath of the financial crisis, three economists championed the seemingly paradoxical notion of “expansionary contractions.”56 (The academy rewards counterintuitive analyses.) They argued that there were important instances where when governments had contracted government spending, the result was that the overall economy grew.

The notion that there could be expansionary contractions was a chimera. A series of papers showed major flaws in their analysis.57 The IMF, which had supported austerity-style policies in the past, in fact reversed itself. It pointed out that when governments contract spending, the economy contracts.58

The big flaw in the pro-austerity study was confusing correlation with causation. There were a few countries, small economies with flexible exchange rates, where a contraction in government spending was associated with growth; but in these cases the hole in demand created by the government contraction was filled in with exports. Canada in the early 1990s was lucky because the United States was going through a rapid expansion, the recovery from the 1991 recession. Canada benefited, too from a flexible exchange rate that enabled it to sell its goods more cheaply to the United States. There is a moral to the story: if you are in a recession, and you want to recover, choose your neighbors carefully. If they are having a boom, you can use that to restart your economy.

But for the European crisis countries in the aftermath of 2008, such “contractionary expansions” were not an option: Europe as a whole—the main trading partner of each of the crisis countries—was experiencing slow growth, if not a recession. Because each of the crisis countries was part of the eurozone, none could lower its exchange rate; and because of the flawed policies of the ECB, the euro exchange rate with the rest of the world was actually very strong. In this context, austerity would produce what it usually does: a slowdown, if not a recession or depression.

The fact that in a few instances austerity was associated with economic expansion only meant this: in these instances, but for the austerity, the expansion would have been even stronger. In some cases, in spite of the expansion of trade, the economy remained below full employment. In such cases, austerity had worsened the level of unemployment; the austerity had not caused the reduction in the unemployment.

An analogy might be useful: When Ronald Reagan became president of the United States, the government undertook two policies almost simultaneously, a large tax cut and very tight monetary policy. The economy went into the deepest economic downturn, the worst, up to that point, since the Great Depression. It would be wrong to infer that the tax cut caused the economic downturn. It simply made the economic downturn less bad than it otherwise would have been.

Before the 2008 crisis, some argued that increased government spending did not increase GDP. The empirical work leading to this conclusion focused on years in which the economy was at or near full employment. When the economy is at or near full employment, there is no room for GDP to increase. Thus, an increase in government spending necessarily “crowds” out other forms for spending. But such analyses have no bearing in a postcrisis world experiencing massive unemployment—in the eurozone, unemployment stands at 10.2 percent as this book goes to press.59 In fact, when there is already a high level of unemployment, there is a “multiplier”—that is, reductions in government spending can lead to reductions in GDP that are a multiple of the cutbacks.60

Another strand of academic work cited by austerity advocates focuses on the consequences of the debt that arises when government spending is financed by borrowing. Kenneth Rogoff and Carmen Reinhardt argued that countries with debt-to-GDP ratios in excess of 80 percent would grow more slowly.61 Upon closer scrutiny, there were major “spreadsheet” and other technical mistakes in their work. More significantly, however, Rogoff and Reinhart failed to test whether growth was lower at higher debt ratios in a way that was statistically significant, and whether this was true always or only under certain conditions. Such a test would have helped to identify the different conditions under which an increase in debt might make a significant difference. There was a further statistical problem—they had failed to show causality: whether low growth had caused the deficits and debts (as was the case after 2008) or, as they claimed, the deficits or debts had caused low growth.62

By itself, the debt-to-GDP ratio does not tell us much about debt sustainability. The ratio may not even be a good measure of a country’s resilience, its ability to withstand shocks, or its overall economic strength. As noted earlier, the United States had a debt-to-GDP ratio of 122 percent after World War II. In the succeeding decades, the country experienced its most rapid growth—this in spite of the fact that war spending does not provide the foundations for future growth as well as does other types of investment. A country that borrows to make productive investment—in education, technology, or infrastructure—enhances its future potential: for most countries, the returns on these public investments far exceed the cost of capital. Thus, such investments, even when debt financed, strengthen the country’s balance sheet and make it more capable of withstanding shocks.

EXPLAINING THE MAGNITUDE OF THE DOWNTURN

Olivier Blanchard, when he was chief economist at the IMF, observed that the economic downturn in Greece was greater than could be accounted for by the amount of austerity that had been imposed. He was of course correct in the sense that Troika models had very badly estimated the effects of their policies. He was saying something more, though: “normal” multipliers—which translate a change in government spending into a change in GDP—would have predicted a much smaller decline in GDP than had actually occurred.

Yet, when the depth of the economic downturn was plotted against the level of austerity imposed, the Greek case did not appear unusual. Yes, the amount of austerity imposed on Greece was greater than that imposed on any other country. But given the magnitude of the austerity, the magnitude of the downturn was much as one would have expected.

While there were many limitations in the standard models63 that help explain why they did so badly in predicting the magnitude of the multiplier—and why Blanchard and others were surprised at the depth of the downturns—the most significant were (1) the failure to analyze carefully the financial sector, and (2) the failure to analyze carefully the distributive consequences of the policies.

The models typically had no banks; this was an especially curious omission, for if there were no banks, there would be no central bank. And how then could we have had the banking crisis of 2008? The focus in the standard models was on the money supply, not on credit. The euro crisis and the way it was managed, however, led, as we saw in chapter 5, to a massive contraction of the supply of credit, especially to small and medium-size enterprises, and this “private austerity” compounded the effects of the public austerity.

Inequality and distribution

The standard models also ignored how increasing inequality affects macroeconomic performance. Indeed, some economists were positively hostile to even discussing the distribution of income.64

The crises, and how they have been managed, have had adverse effects on inequality. In Spain, as we observed earlier, inequality before the crisis had been going down; in the aftermath of the crisis it increased. Inevitably, unemployment increases inequality both directly and indirectly, as wages fall and as government services, upon which ordinary citizens depend, decrease.

Since those at the top spend a smaller percentage of their income than the rest, an increase in inequality lowers aggregate demand, and thus economic performance. This is especially so when, as now, monetary policy is unable to stimulate the economy. In recent years, the IMF has stressed how inequality weakens growth.65

Thus, while the IMF had begun to recognize the importance of inequality for economic performance, and while its own research had provided convincing evidence that government cutbacks would lead to significant contraction, even its research department had failed to ascertain fully the effects of the austerity programs, because their models did not adequately incorporate the dramatic weakening of the financial sectors in the crisis countries and the increase in inequality, and had overestimated the growth in exports and underestimated the impact of the decrease in demand for nontraded goods. But the IMF was only one member of the Troika. And worse, the Troika programs did not seem to consider the possibility of these untoward effects being as large as they turned out to be, even as they were unfolding—and seemed reluctant to reconsider their programs, even as evidence mounted that they were not working in the way anticipated.